Open banking is a win-win for both customers and banks, and it is a trend that is here to stay, Uma explains.

Barter was the initial method of trading. Coins and metals eventually came to be used to give value to trade.

In the past, banks operated in isolation, creating a monopoly. Eventually, many banks in India were nationalized. However, those days are gone, and banks have had to adopt an open culture.

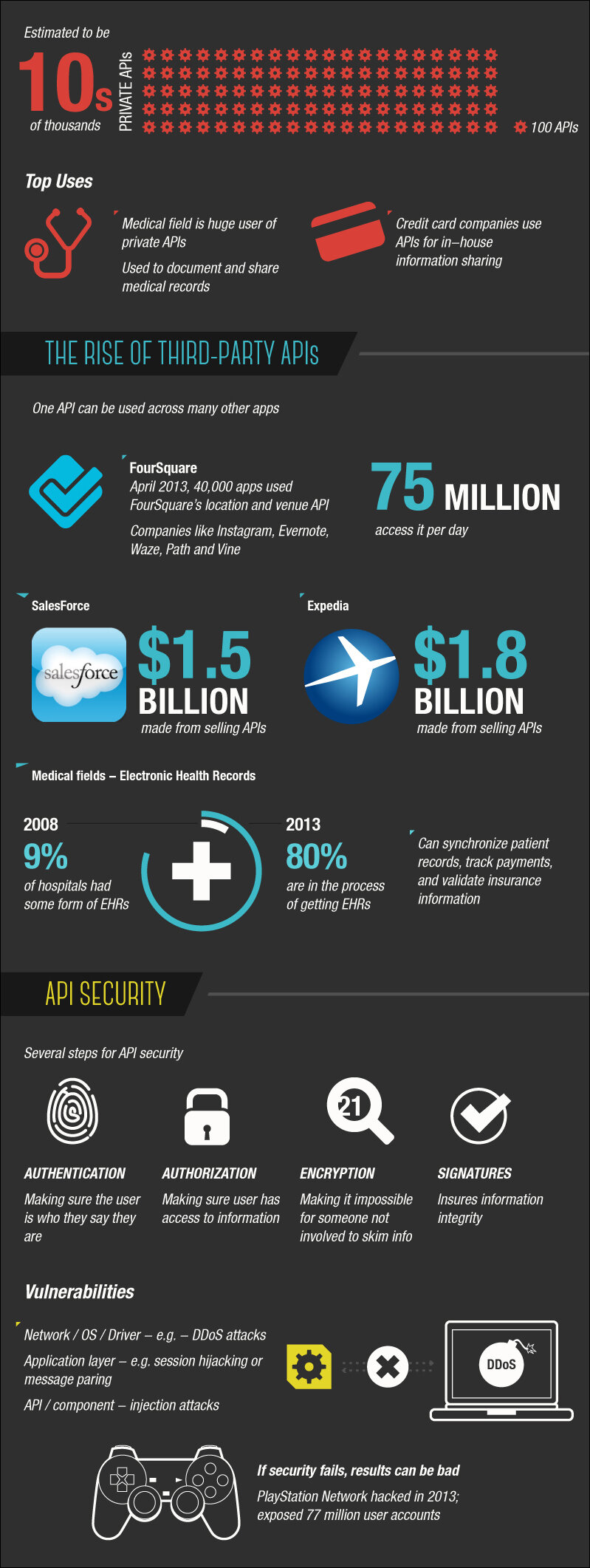

Open banking is the new era, allowing information to be shared outside of banks. This allows fintechs to work with the data and provide convenience and security to end customers.

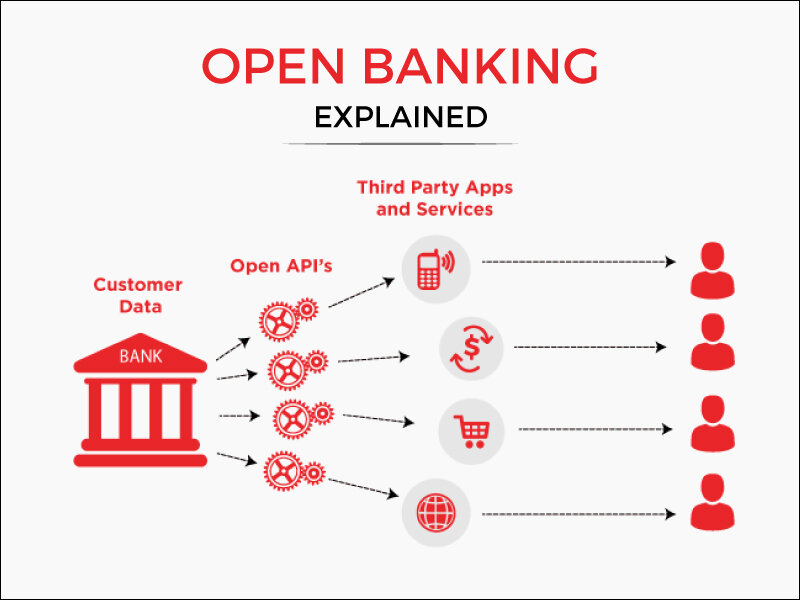

Open banking, in simple terms, is a new way for banks to share their customers’ financial data with third-party financial services providers, such as fintech companies. This allows customers to access their financial information from multiple sources and make better financial decisions.

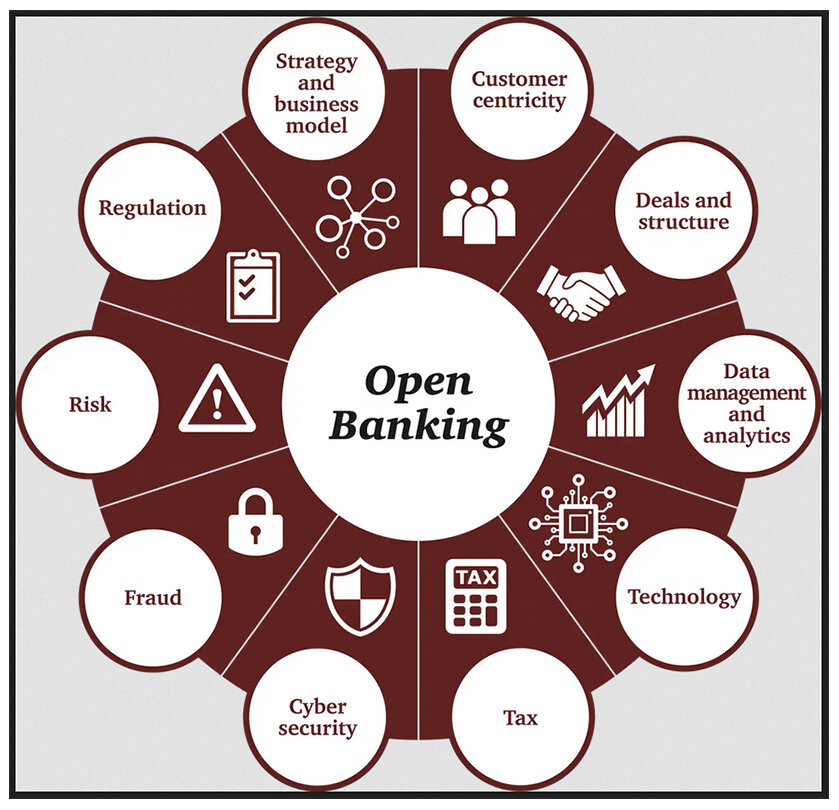

Consent is the key. When we download an application, open a bank account, or start an online transaction, we agree to the terms and conditions, which open us up to “open banking.” We are implicitly giving permission for our data to be shared, but we can revoke this permission at any time. However, this may be inconvenient.

Benefits of Open Banking

- Convenience: Open banking allows consumers to access their financial information from multiple sources and share it with third-party financial services providers. This can make it easier to make better financial decisions, such as comparing loan rates or finding the best deals on financial products. It can also make it easier to switch banks, as consumers can easily port their data to a new provider.

- Enhanced competition: Open banking creates a level playing field for fintech companies, which can offer new and innovative financial products and services. This can lead to lower prices and better service for consumers.

- Improved security and regulatory compliance: Open banking is based on strong security standards, which help to protect consumers’ data. It also provides regulators with a clearer picture of how financial data is being used, which can help to improve compliance with regulations.

In India, the Reserve Bank of India has issued a set of guidelines for open banking, and a number of banks have already begun to implement open banking solutions.

To understand APIs and how they support open banking, we need to understand the history of open banking.

1980: The roots of open banking can be traced back to 1980, when Deutsche Bundespost (German Federal Post Office) ran a screen test with 2,000 voluntary private users and five external computers. The “My bank in the living room” concept enabled users to make online transfers using the code 300#.

1998: In 1998, the Home Banking Computer Interface (HBCI) was developed and further enhanced to Financial Transaction Services (FinTS) in 2002 in Germany. FinTS was an open standard that established a framework for innovation, security protocols, message formats, and transmission procedures. This eventually led to the use of signature cards and Personal Identification Number (PIN)/Transaction Authentication Number (TAN) to access customer accounts for added verification and fraud prevention.

2004: In 2004, HBCI and screen scraping (the process of collecting and sharing screen display data from an application) were combined to create SOFORT, which enabled the first view of showing the customer identity. Once the customer identity was verified, the banking provider would take over and complete all the other activities. This is where APIs came in.

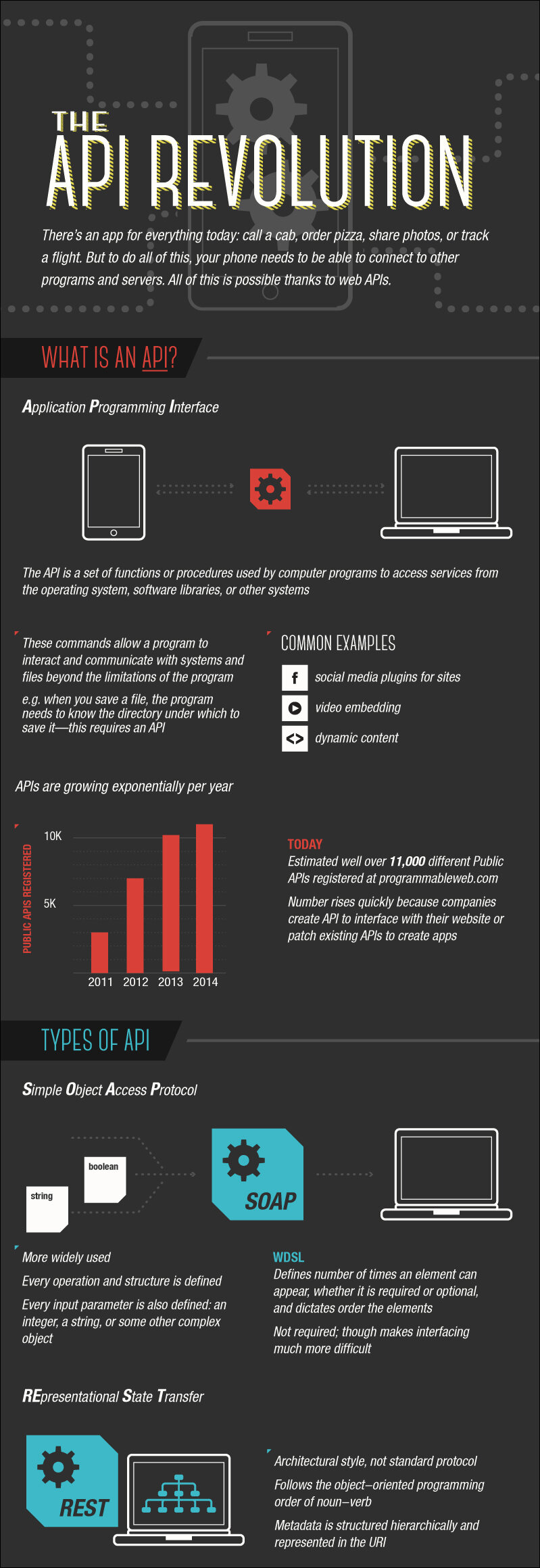

APIs are Application Programming Interfaces that allow two or more software applications to communicate with each other. In the context of open banking, APIs allow banks to share customer data with third-party financial services providers. This data can be used to create new and innovative financial products and services for consumers.

At the time, screen scraping was seen as innovative, however, APIs are the more secure and straightforward option.

2007: The European commission caught on and devised the PSD1(Payments services directive) to enable competition and help protect end users and set up a regulatory framework.

2018: A lawsuit then replaced PSD1 with PSD2, which removed the unfair advantage and opened up the integrated and efficient way operations of the European payments market and level the playing field. It required the banks to expose their open banking API to authorised third parties. open banking API for third-party providers helped bring in innovation.

What did it mean for India and the rest of the world?

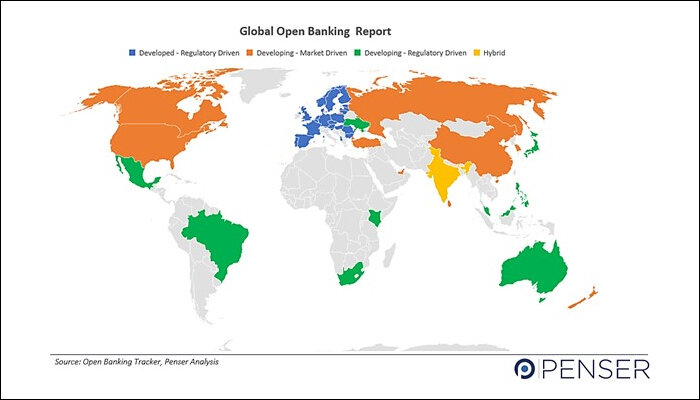

Open banking, which was once thought to be limited to the United Kingdom and Europe, has been adopted by the majority of Indian banks. Outside the United Kingdom and the European Union (EU), open banking is either market-driven or regulatory-driven.

- Market-driven: Japan, the United States, India, and Singapore use a market-driven approach. Banks and third-party providers are permitted to develop their own API platforms. The government supports partnerships between banks and third-party providers, but it does not regulate or interfere with the design or development of the APIs. Limited government oversight and the absence of an industry-wide API strategy have resulted in screen scraping remaining a major concern.

- Regulatory-driven: Hong Kong and Australia have a regulatory-driven open banking approach that is similar to that of the United Kingdom and the EU. Government regulatory agencies play a vital role. APIs must adhere to government specifications. The government oversees and regulates data sharing.

How does India fare?

India’s open banking is more hybrid. India’s open banking infrastructure is known as the ‘India Stack’, an initiative taken almost a decade ago in 2011. The view is to promote inclusion of neobanks and other Fin tech providers and enhance the competition. It also aims to improve the delivery of financial services to the Indian population. India successfully implemented the Unified Payment Interface (UPI) system in 2016 (the UPI system really helped the promotion of Digital India and during COVID with PhonePe, GPay etc. ‘The mobile platform enables users to connect their bank account(s) to registered mobile wallets, which enable digital payments and transactions. According to a report by Credit Suisse, India’s UPI system has been a major driver of accelerated payment digitalization in India. In the last 5 years, the UPI system has grown 10 times, constituting almost 30% of the retail transactions. ‘

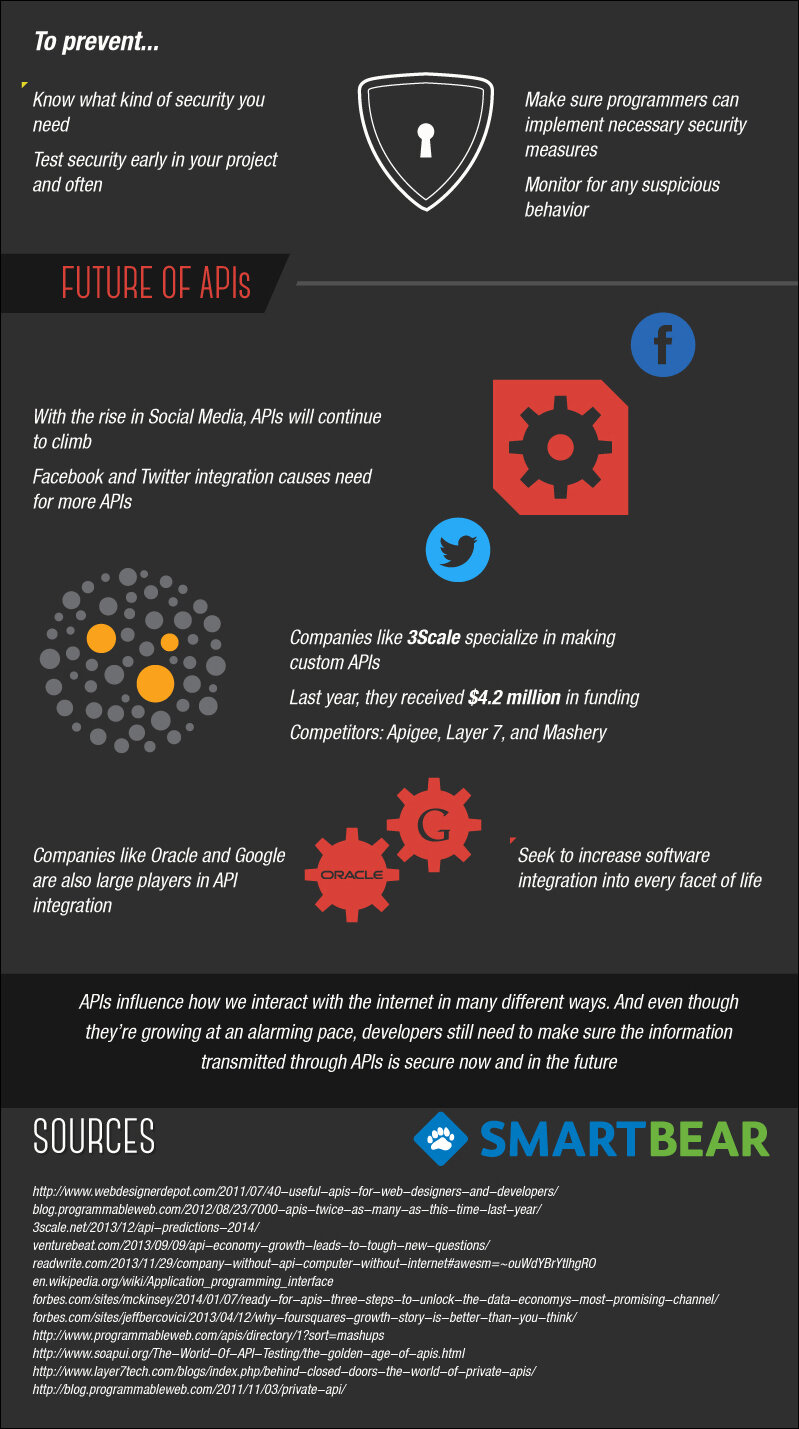

AI and the Future of Open Banking:

AI can use open banking information and Named Entity Recognition (NER) and Natural Language Processing (NLP) to extract relevant information from text data. This is an invaluable Machine Learning technique in Open Banking, as open banking data often includes text.

For example, NER is often used to extract and analyze a consumer’s bank transaction data. A recent transaction might look like this: May 16, 2023 – Uber Trip – $12.25. The text of “Uber Trip” in this transaction is the transaction description. NER can look at a consumer’s transaction data in text form and identify the merchants, so this information can be used to enable intelligent decisioning, such as payment patterns and utilization trends.

‘A report by Allied Market Research announced a 24.4% growth and predicts the market value will reach over $43 billion by 2026.’ This is only the beginning of the advent of opening the banking industry along with the power of AI.

Open banking is causing a major change in how banks operate, but it is a change that is necessary to keep up with the evolving financial landscape. Open banking is a win-win for both customers and banks, and it is a trend that is here to stay.

In case you missed:

- None Found