Due to the use of Artificial Intelligence in the taxation system in India, it is becoming harder to commit tax fraud writes Satyen K. Bordoloi

Last year when the GSTN authorities in UP put the activities of traders through BIFA – an AI software to detect transactional anomalies – the name of a textile company in Hapur district came up. Despite a turnover of Rs. 25 crores, it had not deposited tax even once. The firm was using input credit from bills that had a value under Rs. 50,000 to avoid detection. The fraud had escaped human eyes, but not the AI system.

BIFA stands for Business Intelligence and Fraud Analysis – an AI system that was incorporated by GSTN (Goods and Services Tax Network) with the help of Infosys. It has already helped analyse and detect a lot of tax evasion fraud across the country. With AI being the front and centre of discussion across the world thanks to ChatGPT, the Government of India using it in tax detection should come as a warning to defaulters as tax filing season approaches.

Origin of BIFA

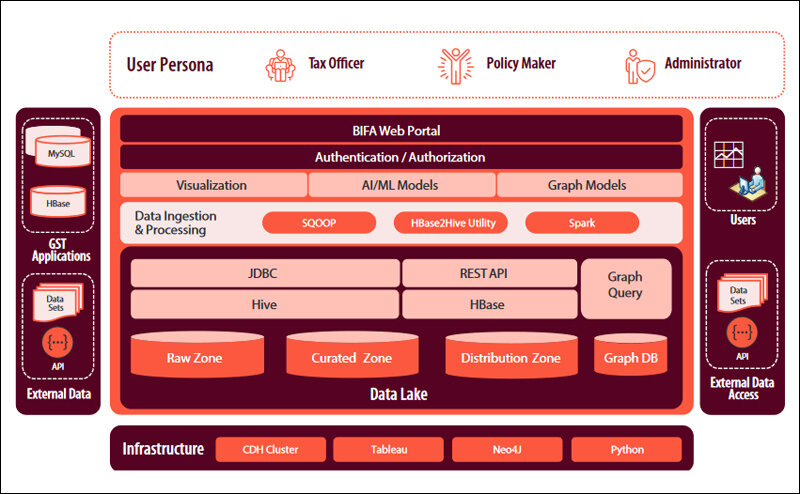

A new GST regime came into effect in India from 1st July 2017. Since then, GSTN has brought its 1.3 crore taxpayers on the new taxation model. Naturally, along with it came the scope for fraud. To support this massive transformation involving such a large number of taxpayers, an Infosys case study notes, “GSTN partnered with Infosys to build a highly scalable and responsive application platform that serves the needs of Tax Payers, Tax Officers, and other stakeholders.”

In the three years that GSTN had been working, it accumulated a big volume of data about taxpayer demographics, invoices, eWay bills, tax payments, and tax returns filed. Data from external sources such as Customs, and Direct Taxation systems were also available to derive insights. Infosys formed a team to create the architecture for a data and analytics platform to meet GSTN’s needs.

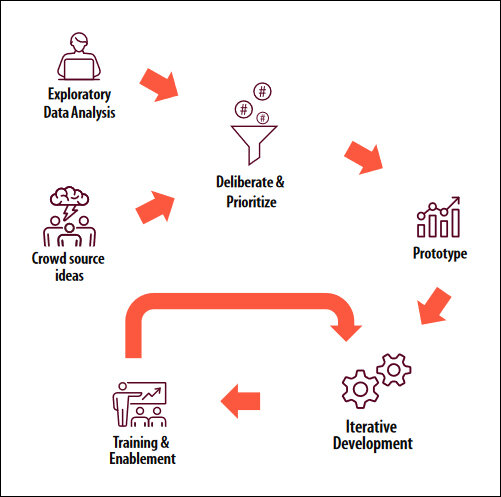

They studied the analytics capabilities available to tax officers across the world to understand and if possible, adopt best practices in an attempt to make BIFA the best analytics and fraud detection platform in the world. However, the team realised that very little of it was available in the public domain. This was disappointing but proved to be an opportunity as the team was forced to create its own model from scratch with help from tax officials across the nation.

The result was a system that identified mismatches between returns filed by taxpayers to help identify fraud, used Machine Learning to identify anomalous and thus potentially fraudulent transactions, used graph algorithms to identify communities of taxpayers involved in fraud, performed fraud propensity analysis of individual taxpayers, developed models to identify entities that were not covered under GST and enabled tax filing compliance analysis among a host of other business analysis and data gathering tools not just for the government, but also for the businesses that paid the taxes.

The result, as per Prakash Kumar, CEO, GSTN was that “Within three months of launching the BIFA tools, tax officers across the country have been able to uncover 50 million USD of fraud and have initiated the due process for recovery for the same.”

The ‘Intelligence’ Capabilities in AI

(Image Credit: Infosys)

The one thing AI is exceedingly good at, is pattern recognition. This is priceless when it comes to taxation because taxation is nothing but a lot of different types of numbers presented in different ways and systems across different departments under central and state governments in India. This is right up AI’s sleeve as it can analyse a large volume of data from multiple sources like retail data, payment history, browsing data, and different types of tax payment history to detect patterns of suspicious activity.

What has thus helped, is that over the last decade, almost everything to do with taxation has been digitised. Tax filings by individuals and businesses small and big have also gone digital. What this means is that no person or business can hide their fraud under mountains of paperwork that used to happen in the old tax regimes. That, however, does not mean that smart crooks cannot hide their fraud under mountains of digital data. They can, and they already have.

However, what has changed is the advent of artificial intelligence and machine learning. Using AI and ML, the mountains of data available across systems are not only mined but cross-referenced. These advanced analytics have become key to gaining actionable insights because it is not possible for humans to sieve through such a variety and complexity of data themselves.

The Future

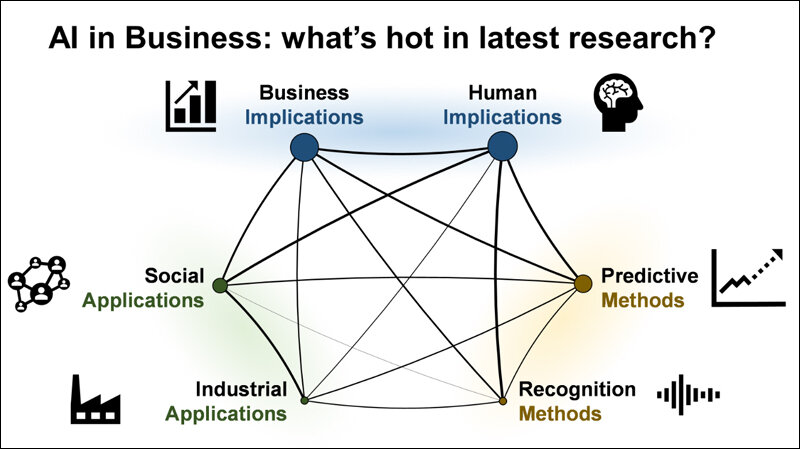

(Image Credit: Wikipedia)

The greatest strength of using AI in taxation fraud detection is that the ‘learning’ in Machine Learning kicks in. The system gets better and better the more it handles data at detecting anomalous patterns in them. This can be beneficial in two ways. One is obviously faster detection of fraud.

However, the second advantage is much more exciting. Such learning systems, based upon years of fraud detection, can become good at predicting where the next fraud is likely to appear so that authorities can take precautionary measures against this. Let’s take an example of this.

The business of scrap is largely a cash business. Based upon previous patterns of fraud detection, the AI system draws attention to the pattern that for the past four years, the percentage of tax fraud detected in that business, has remained steady. Thus, authorities can put extra attention on this segment to figure out a way to plug the loopholes.

Taxation may have become complex and multi-pronged, but the possibility of deep analysis of data from multiple sources to find patterns thanks to AI is a priceless tool. It not only ensures that tax authorities in India stay ahead of fraudsters, but one day, make it impossible for the criminally minded to attempt it, aware as they would be, of the hawk eyes of artificial intelligence.

In case you missed:

- AIoT Explained: The Intersection of AI and the Internet of Things

- Rogue AI on the Loose: Can Auditing Uncover Hidden Agendas on Time?

- Rethinking AI Research: Shifting Focus Towards Human-Level Intelligence

- Copy Of A Copy: Content Generated By AI, Threat To AI Itself

- Digital Siachen: Why India’s War With Pakistan Could Begin on Your Smartphone

- Rise of Generative AI in India: Trends & Opportunities

- Google Falters Under AI Onslaught: Future of Search in Peril?

- Quantum Leaps in Science: AI as the Assembly Line of Discovery

- Unbelievable: How China’s Outsmarting US Chip Ban to Dominate AI

- The Path to AGI is Through AMIs Connected by APIs