Despite cloud being the buzzword in IT, why is it not as straightforward for organizations seeking Next Generation operations?

For most enterprises, cloud and SaaS-based solutions are the preferred option when specifying requirements for Next Generation tools. However, there is more to consider than meets the eye. Achieving the ideal solution you desire comes at a cost, and as Sima aunty would say, this means “compromise and adjustment.”(Reference: Pop Culture Netflix show Indian Matchmaking!)

Why is the cloud not all it seems?

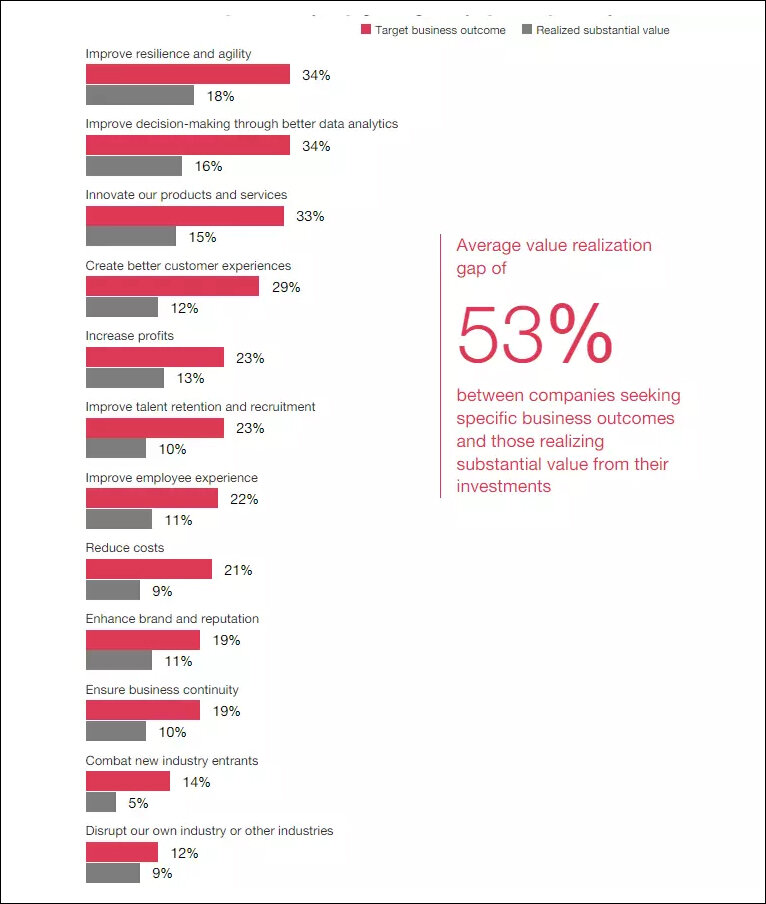

- 49% of cloud-based businesses struggle to control cloud costs. (Source: Anodot)

- In 54% of cases, cloud waste stems from a lack of visibility into cloud costs.

- According to 44% of executives, at least a third of their cloud spend is wasted.

- Complex cloud pricing is a challenge for 50% of respondents.

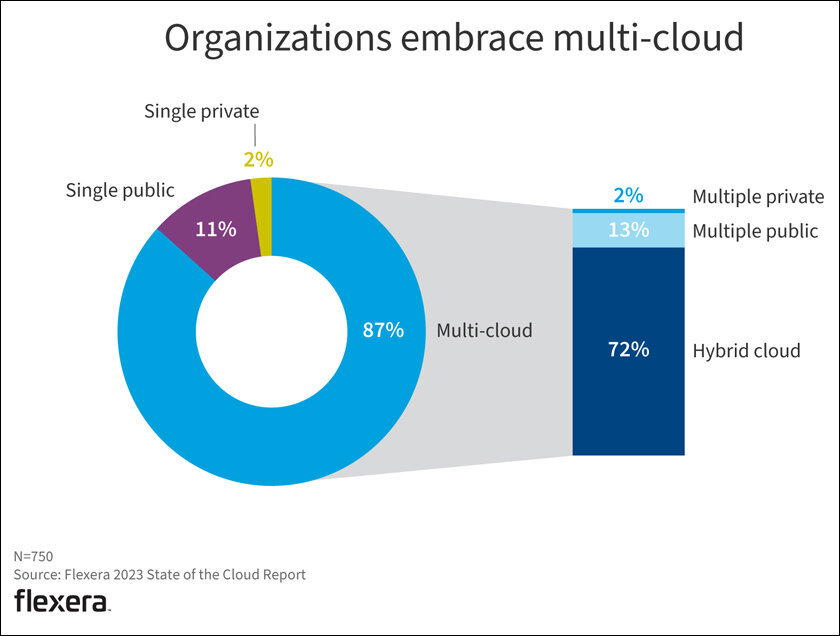

- Nearly half of respondents said managing multi cloud environments is challenging.

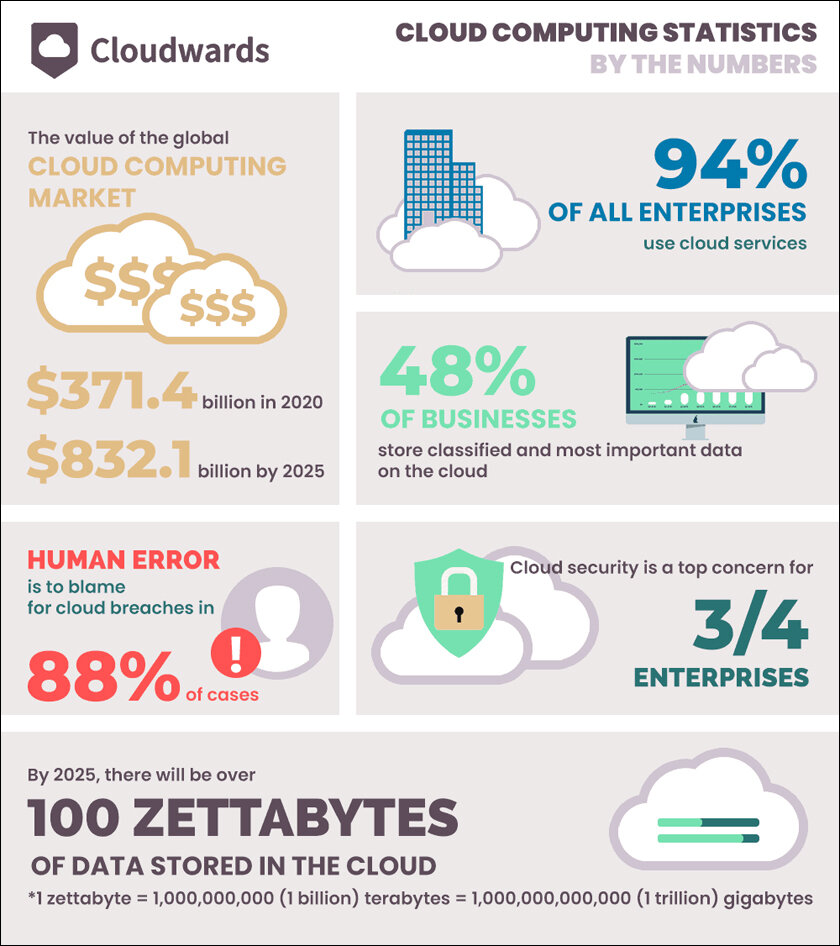

The data is staggering 101+ Cloud Computing Statistics That Will Blow Your Mind (Updated 2023)

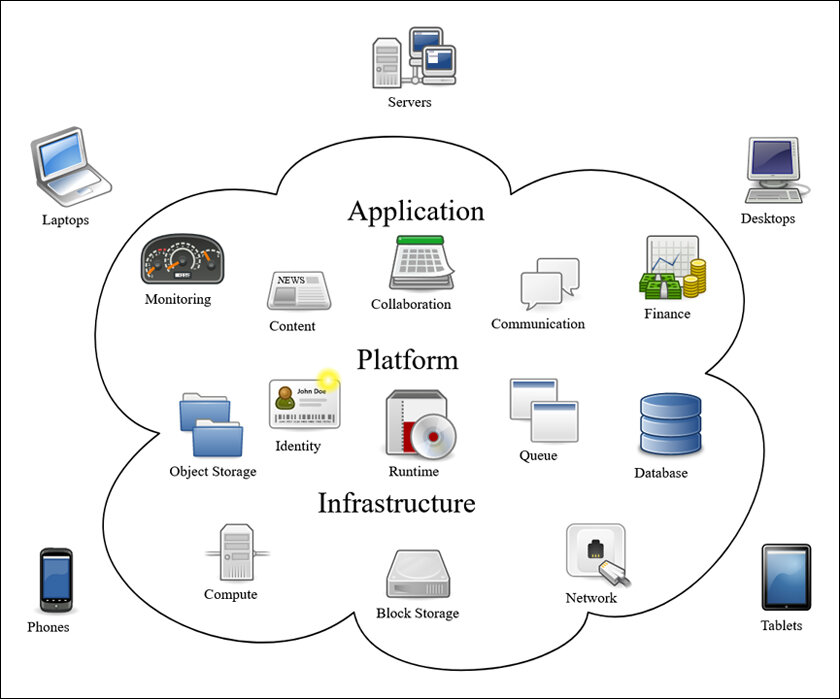

Flexibility: Cloud is not flexible when you need a vendor to provide services.

Fun fact: It took Netflix seven years to migrate to AWS.

Vendors have specific agreements with cloud providers for their SaaS provisioning. These agreements often include terms that restrict the vendor from providing services on other clouds. This can make it difficult to be flexible with your cloud provider, as you may be locked into a specific vendor.

In addition, vendors are not typically comfortable providing cloud-agnostic solutions. This is because cloud-agnostic solutions require the vendor to have expertise in multiple cloud platforms. This can be a significant investment for the vendor, and it may not be worth it for them to provide a cloud-agnostic solution if they only have a few customers who need it.

Finally, even if a vendor is willing to provide a cloud-agnostic solution, it will typically come at a cost. This is because the vendor will need to invest in the expertise and tools necessary to support multiple cloud platforms.

For these reasons, it is important to consider the flexibility of your cloud provider when choosing a vendor. If you need a vendor to provide services, you may want to choose a vendor that is comfortable with cloud-agnostic solutions. You may also want to be prepared to pay a premium for a cloud-agnostic solution.

Cost of Cloud

All cloud providers offer expandable storage, but it will come at a cost. The pay-per-use model is common, but there may be additional costs and clauses to consider.

- Storage costs: Cloud providers typically charge a per-GB or per-TB rate for storage. The cost will vary depending on the provider, the type of storage, and the region where the data is stored.

- Bandwidth costs: Cloud providers also charge for data transfer in and out of the cloud. The cost will vary depending on the amount of data transferred, the speed of the connection, and the region where the data is transferred.

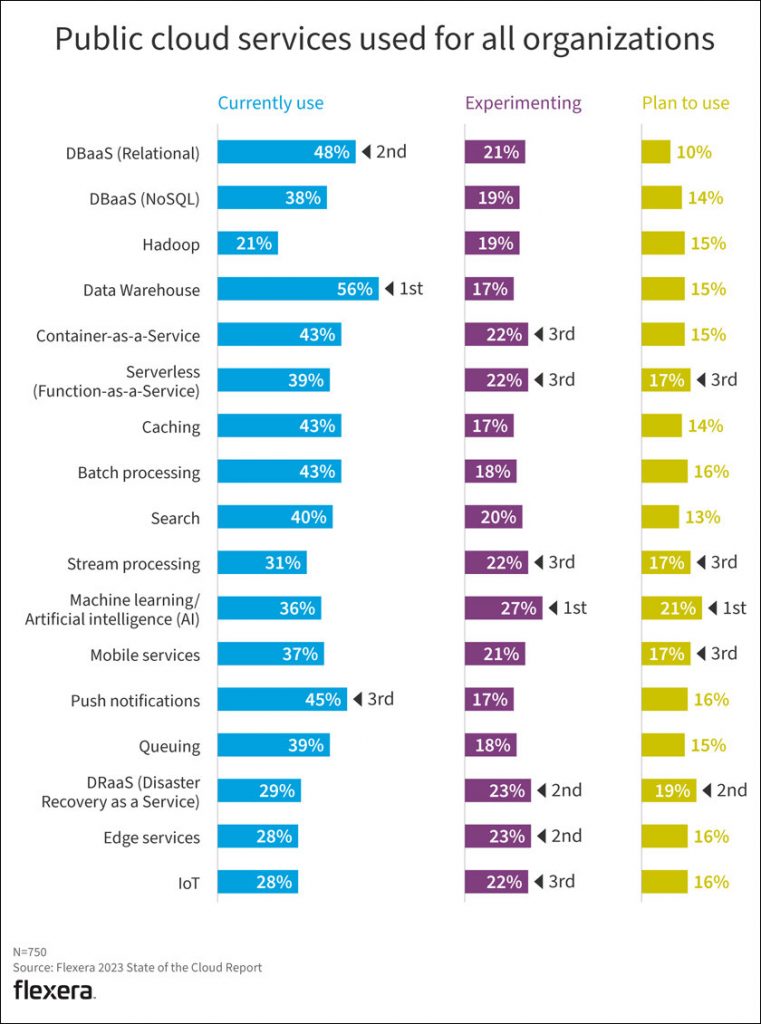

- Other costs: Cloud providers may also charge for other services, such as data analytics, machine learning, and artificial intelligence. These costs can vary significantly, so it’s important to read the fine print before signing up for a cloud service.

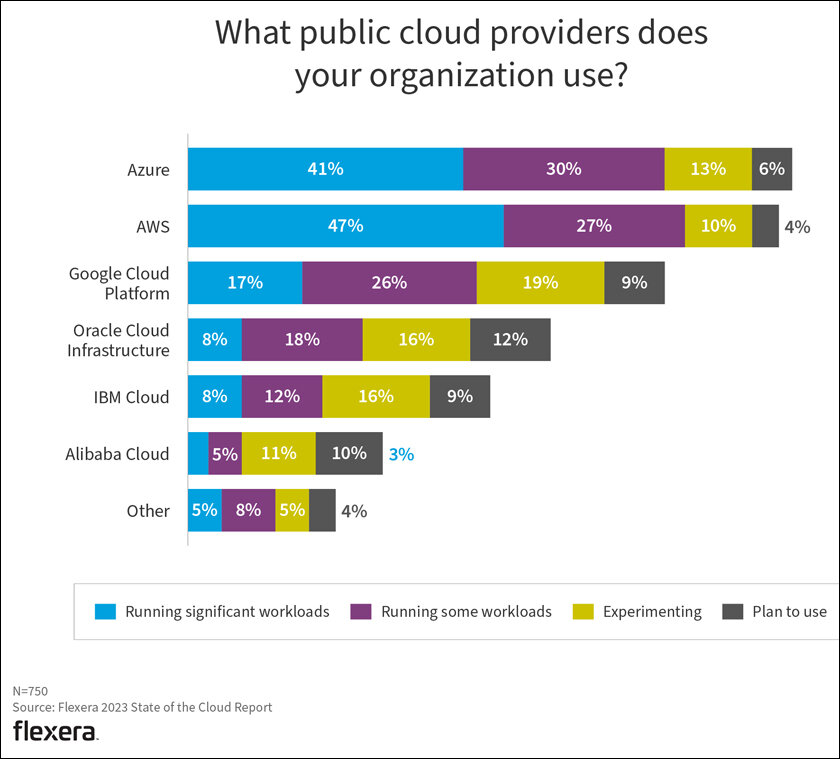

Fact: Flexera also found 53% of enterprise users on Azure spend over $1.2 million each year vs. 52% on AWS.

Exit clauses:

- It may be difficult to move from one cloud provider to another. This is because each provider has its own unique architecture and set of APIs. Moving data and applications from one provider to another can be a complex and time-consuming process.

- The cost and commercials of a cloud provider may be cheap initially, but provisioning may cost way more in the long run. This is because cloud providers often charge for things like storage, bandwidth, and compute resources on a pay-as-you-go basis. Over time, these costs can add up, especially if you are not careful about how you use your cloud resources.

- Cloud providers may also have hidden fees or charges that you may not be aware of. For example, some providers charge for data egress, which is the cost of transferring data out of your cloud account. These fees can add up quickly, so it is important to be aware of them before you sign up for a cloud provider.

Application support limitation:

Not all applications can be supported by SaaS-based solutions. This is because SaaS-based solutions are typically designed to support a limited number of applications, and they may not be able to support applications that require a high level of performance or security. For example, CAD and graphic design software often require a high level of performance, and they may not be able to run effectively on a SaaS-based platform. Additionally, some applications require a high level of security, and they may not be able to be hosted on a SaaS platform that is shared with other users.

If you need to use an application that is not supported by a SaaS-based solution, you may need to consider using a traditional on-premises solution. On-premises solutions are typically more expensive than SaaS-based solutions, but they offer more flexibility and control over the applications that you can use.

Last but not the least is Security:

Hacking and security is a major concern for financial institutions, especially those that store large amounts of sensitive data. Single tenancy and multi-tenancy models both have their own unique security risks. In a single tenancy model, all of the data on a server is owned by a single tenant. This means that if the server is compromised, all of the data on it is at risk. In a multi-tenancy model, multiple tenants share a single server. This can help to reduce costs, but it also increases the risk of data breaches. If one tenant’s data is compromised, it could potentially put all of the data on the server at risk.

– GDPR (General Data Protection Regulation) is a European Union regulation that sets strict rules for how personal data is collected, used, and stored. Financial institutions that do business with EU residents must comply with GDPR. GDPR compliance can be a complex and expensive process, but it is essential for financial institutions that want to protect their customers’ data.

– Smaller financial institutions may have a higher risk appetite than larger institutions. This is because smaller institutions typically have fewer resources to devote to security. Larger financial institutions, on the other hand, have more resources to invest in security measures, such as encryption, firewalls, and intrusion detection systems.

– Encryption is a key security measure that can help to protect data from unauthorized access. Encryption scrambles data so that it cannot be read without a key. Encryption can be used to protect data at rest (data that is stored on a hard drive or other storage device) and data in transit (data that is being transmitted over a network).

– RTO (Recovery Time Objective) and RPO (Recovery Point Objective) are two important metrics for measuring the effectiveness of a financial institution’s disaster recovery plan. RTO measures the amount of time it takes for an organization to restore its IT systems after a disaster. RPO measures the amount of data that is lost in a disaster. Financial institutions should strive to have a low RTO and a low RPO.

Conclusion:

Before selecting a cloud provider, it is vital to consider all of the following factors:

- The specific services and features you require

- The size and growth of your data

- Your security and compliance needs

- Your budget

In addition to the above factors, it is also important to consider the flexibility of your cloud provider. You may want to choose a vendor that is comfortable with cloud-agnostic solutions.

Financial institutions need to be aware of the security risks associated with cloud computing. They should take steps to protect their data from unauthorized access, such as by implementing encryption, firewalls, and intrusion detection systems. Financial institutions should also have a disaster recovery plan in place.

When evaluating cloud storage costs, it is important to consider all of the factors involved. The total cost of ownership (TCO) of a cloud storage solution can be much higher than the initial storage costs.

If you are unsure of which provider is right for you, it is a good idea to speak with a cloud expert.

In case you missed:

- None Found