A global leader reveals why CMOs should promote stories than tech jargons

Meet FIS, a global tech major that makes close to $9 billions every year. Four years ago, when Bandhan Bank was being setup, FIS was in the news with the bank opting FIS’ systems for its back-end. The deal was a per-transaction basis cost, considered by many bankers as novel and one of a kind in the industry.

Ellyn Raftery, the Chief Marketing and Strategy Officer at FIS wished she had a saree that day while narrating the day of the launch.

Raftery looks forward to building stories similar to the one during Bandhan Bank’s grand launch. She believes such stories are more helpful when it comes to marketing than mere tech-jargons. “It was a giant ceremony that went on for hours. We had special VIP seats to watch the minister of finance inaugurate the bank’s branch,” she said.

Raftery in her role at FIS as its CMO has witnessed subtle and disruptive changes in the technology landscape. In a conversation with Sairaj Iyer of Sify.com, she talks about the life of a marketer, new tools and the strategies at FIS.

Excerpts:

Sify.com: Tell us a bit about FIS, the $9 billion tech major

Ellyn Raftery: We are a white-labelled brand that builds software. Our software helps run financial institutions.

It is our software that runs behind most of the crucial financial services. Our partners (Clients) re-skin our software to offer their customers banking services. As an example, we built a mobile banking app. Banks buy that service from FIS, add a few features and re-skin that app. Bank’s customers see their banking logos, however beneath that tool it is FIS that runs the software and apps.

Does it affect that your work is a bit of product marketing, a dash of services marketing and also categorized under tech marketing. Phew, does that mean any limitations?

I think we have a huge opportunity considering we are a global brand and one very well known in tech circles. Banks understand who we are and realise that they need our technology to run their enterprise.

But end-customers may not be obvious of our brand. That’s a part of our business strategy as well as a challenge. We have an opportunity considering we are a very niche player specializing in financial services with domain expertise and having a broad global portfolio. With our capabilities, we have the scale and breadth of enterprise level solutions that we are able to bring to our clients.

Does it affect that some of your peers such as IBM or SAP have bigger sub-vendors or partner networks whereas at FIS most of the selling is via the in-house channel?

I don’t look at it from that perspective. In fact, we do have some resellers, especially in a few markets. But, we are majorly driven via our products and marketing of those ready-made solutions. As such, we are a company that is very client intimate.

Managing a lifecycle of sales is important for us. We want our clients to benefit from what we are producing. As a company we don’t look at duplicating what the client wants and we don’t have. Our mission is empowering financial institutions. The reseller strategy disrupts our relationship with the client and doesn’t allow us to benefit from the end-to-end sales-lifecycle. Also, there is no impact on not having a reseller network.

How has disruption in banking and financial services changed your profile?

I would say that disruption has added distraction. For instance with disruption coming in, we have to be constantly aware of the whole business landscape. Our portfolio is so wide, that we have a lot of competitors, and we have to constantly watch the market dynamics.

Also, there are newer technologies. A marketer has to constantly keep in sync with this market as well as reach out to various data points and leverage it to be more efficient. Be more segmented and more targeted. A marketer also has to look at newer channels, including social capabilities to pass on a message faster, effectively, and to the right target audience. A marketer is constantly on the prowl for searching the right channels as well as keeping the demand generation engines moving quickly, understanding the fine shift in strategy, creating an effective content marketing plan. Ultimately, it boils down to having the right talent around you and being continually open to evolving around the organisation.

Besides all this, we are also exploring newer areas such as experiential marketing and implementing them in an efficient manner. Besides the external disruption, as a company, FIS has invested in a lot of modernisation of existing solutions and services.

What investments are these?

As a company we invest approximately 6% of our revenues back into investments. This is a part of our investment in Research and Development. Some of that goes into investments within start-up companies, our venture centre, and also investments in early to market products. Some of these products are on modernisation, some on continuation and some in last stage product lifecycles.

Could you elaborate on specific technologies that you have invested on?

We have a lot of investments in Open API, about 3,000 investments to be precise. Also, we have our Code-Connect solutions, which are all open-API- the open gateway solution. We have also invested in unified payments, an open platform on our payment solutions to provide a single thread across all channels. The other solution that we will be rolling out soon is ‘Digital One’.

Digital One is a turn-key solution that offers our set of digital offerings. This product integrates the front end with core banking solution. It is completely componentized and is a plug and play sort of format. We will roll this product in the United States sometime around mid-Summer. The India launch should be sometime around end of 2019.

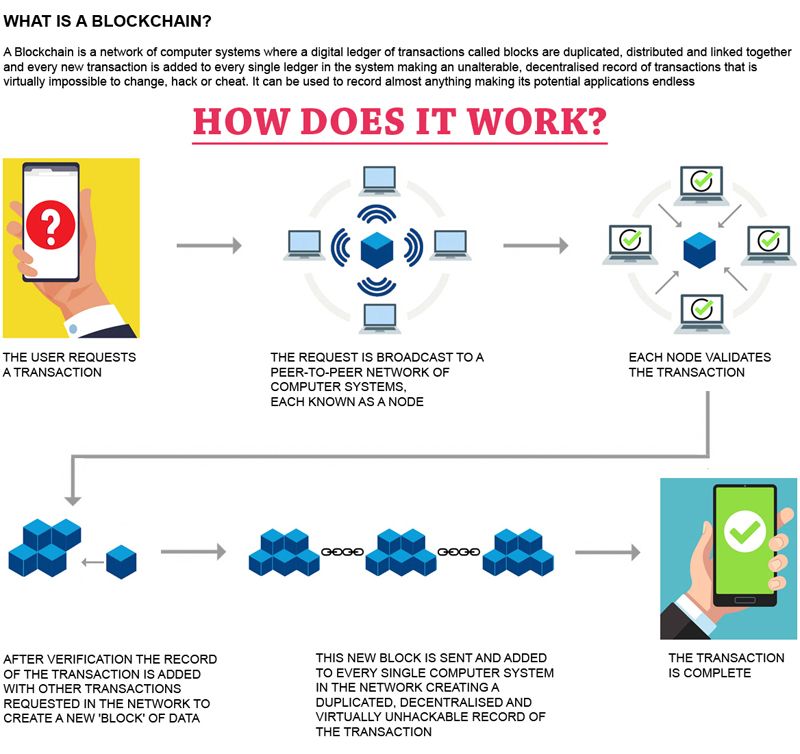

Speaking of solutions how is the demand for Blockchain?

There is a lot of news and market-buzz around blockchain and distributed-ledger but not a lot of demand.

Tell us a bit about how different your target groups in the US are from that of India?

There was a difference, but that was several years ago. This difference-gap has shrunk in recent times. For instance several years ago, adoption of digital and automation in the US was higher. Today the demand is almost similar. But there is a difference in the mission, overall challenges, and the ways and means to getting a solution.

For instance, in the UK the challenge is bank consolidation, integrating with newer start-ups. The missions we are selling in the UK are centred on such issues. In India, 2-3 years ago the focus was financial inclusion, serving the under-served. Part of that was initiated with Bandhan Bank. Also the theme of Financial Inclusion in US from that of India or other emerging markets is different and hence the technology implementation journeys and solutions implemented may also be different.

A common grouse with marketers is on usage of jargons. For instance, there is no clarification on how Big Data is, but ‘Big Data’ is found everywhere in marketing literature.

I think there is no substance behind that BIG IDEA.

Then there is that advanced analytics, a tool that some open-source spreadsheet apps offer…

Buzzwords or Keywords are of no value. It’s important that a marketer breaks down complex jargons into easy to understand stories. I think the emphasis has to be on creating compelling stories. Our in-house demand generation is based on digitally executed campaigns. Central to these campaigns are stories written by copywriters. The base for these copywriters is to narrate compelling digital stories. We have observed that Hyperboles don’t do anything for demand generation. Stories, personally targeted towards a persona, image or journey will be far more meaningful than jargons. I think customers connect with content that simplifies the complicated.

Can you elaborate on the Demand generation process and how it looks?

There are two aspects to our demand generation process. The first part is certainly the technology. In order to be effective at demand generation especially in the digital channels, you need to have a strong technology stack. Systems such as Marketo or other tools that helps getting the content distributed, and then nurturing leads once someone opens or touches that content in some way.

Second part is naturally the content. Technology means nothing if you don’t have content to put in that demand-gen channel.

So we are using marketing as the tip of the sales sphere in a much more effective way to advance the selling cycle. So, by the time the sales person speaks with the client, the marketing team has already touched that prospect at least 9 times. By the time, the sales person starts talking the marketing team has already warmed the client and offered lots of information about the product and other solutions.

Tell us a bit about the Gender disparity in Management roles

I think the profile is different in parts of the world. For instance the US has more women in technology or senior profiles. But as we speak, there is a definite market-shift. There is a focus on bringing female power and building up investments in colleges, intern programs and hiring to bring around that diversity in corporate boardrooms. Diversity is a real board room issue, not just for FIS but for all major companies.

Are there any India specific strategies for 2019?

I think the marketing focus on India is to be highly engagement oriented. That is, making ourselves easier to find and buy FIS products and services. We are also looking at things such as customer loyalty and retention programs, and we need to do that to continue that journey of clients and loyalty. Our strategy would continue on content marketing. We dont invest in advertising. In fact our thought leadership leverages from our content. The campaigns such as experiential marketing, gamification, augmented reality to market our company to bring value different than our competitors would also continue.

Being a B2B2C company, we sell more directly, and build upon unique user journeys. Gamification, Augmented reality allows us to show our clients how their users might adopt to their products. This also helps our clients visualize how they can save money or earn from newer offerings by leveraging from our products and services.

In case you missed:

- None Found