While there may be exceptions, available data suggests that dynasty-based management is not conducive to a technology company’s success.

Succession is a widely acclaimed, popular and relevant TV show on HBO that highlighted the power struggles within a dynasty led firm. The show follows the Roy family, who control Waystar Royco, a global media and entertainment conglomerate. The family is led by Logan Roy, a ruthless and domineering patriarch who is nearing retirement. As Logan’s health declines, his four children begin to jockey for control of the company. The show’s depiction of the Roy family’s power struggles is a reflection of the real-world power struggles that are taking place in the corporate world. The show also explores the ways in which wealth and power can corrupt individuals and families.

While the show is a cautionary tale about the dangers of power and wealth, it is a reminder that even the most powerful families are not immune to the destructive forces of greed and ambition. Over time, Reliance dynasty prospered under Mukesh Ambani, but is floundering under Anil Ambani’s leadership. This leading to believe that it is not always the laws of succession within family is always successful.

In the past, family-owned non-technology businesses have been successful. Family members often work well together and share a common goal. However, this trend has not been seen in the technology industry. Although family members may own shares and serve on executive boards, the CEO position is typically not handed down from one family member to the next.

However, technology has now changed where family businesses once were passed on from one family member to the next unlike dynasty politics.

Although the top family-owned technology businesses were not traditionally technology businesses, they were diversified and rode the IT wave in the 1990s and 2000s. Reliance, Tata, Infosys, and Wipro are good examples.

– “The largest 500 family enterprises generate US$8.02 trillion in revenue – up 10% from 2021.

– The inflow of new entrants, mainly from Europe (35%), is mostly public (62%). Almost half (47%) are from manufacturing, reflecting recovery in the sector.

– Women hold only 23% of board seats, indicating more needs to be done to close the gap.”

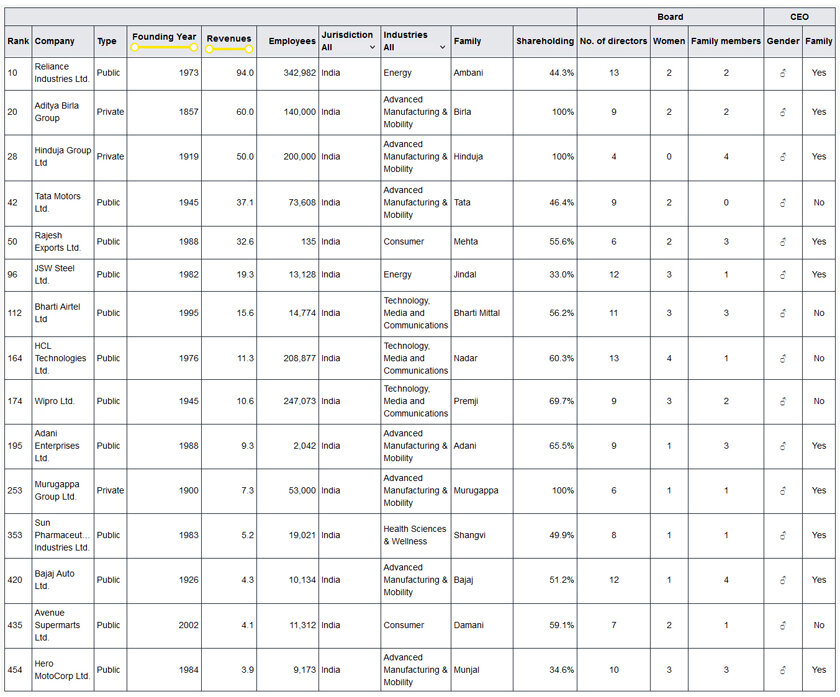

Check out the staggering yet detailed list of the top companies in this report. Global Family Business Index.

Apart from Bharti, which is classified as technology and telecom, HCL, Wipro, and Reliance are among the most notable companies. Tata and Reliance, although they both have technology wings, are not listed under the technology banner.

India Tech and non tech listing:

Lets see some statistics across the world:

Of the companies on the index, just over half (55 percent) have a CEO who is not a family member. This is in contrast to companies like Koch Industries, Dell, Comcast, and Bosch, which are all still headed by a family member.

Older companies are less likely to be led by a family member. For example, Indian conglomerate Aditya Birla Group, which ranks 20th on the index, is one of only a quarter of firms aged 150 years or more that are still helmed by a member of the family.

Notably, the proportion of companies without a family CEO is almost as low among the youngest companies.

Google, Apple, Tesla, what are the models that makes them thrive?

Google and Microsoft:

It is interesting to know the succession plans of companies that are in the top tech tier.

With Sundar Pichai and Satya Nadella at the helm of Alphabet (Google) and Microsoft, respectively, it is clear that merit alone can turn a company’s fortunes around.

Pichai joined Google in 2004 and quickly rose through the ranks, becoming CEO in 2015. Under his leadership, Google has continued to grow and innovate, becoming one of the most valuable companies in the world. Nadella joined Microsoft in 1992 and served in a variety of leadership roles before becoming CEO in 2014. Under his leadership, Microsoft has also transformed itself, becoming a more customer-centric and innovative company. Although Bill Gates holds the majority of the shares in Microsoft, it is not his family that pulls the strings of the company. Instead, the board of directors is responsible for making decisions about the company’s direction. The board is made up of independent directors who are not affiliated with Microsoft. These directors are responsible for hiring and firing the CEO, approving the company’s financial statements, and setting the company’s strategic direction.

Gates’ family does not have a significant role in the day-to-day operations of Microsoft. Gates’ wife, Melinda, is a co-founder of the Bill & Melinda Gates Foundation, and his children are not involved in the company. Gates himself has stepped back from a day-to-day role at Microsoft, and he now focuses on philanthropy.

The board of directors is responsible for ensuring that Microsoft is run in a responsible and ethical manner. The board also has a fiduciary duty to the shareholders of Microsoft. This means that the board is responsible for protecting the interests of the shareholders.

Both Pichai and Nadella are highly talented and experienced executives who have a deep understanding of the technology industry. They are also both passionate about using technology to make a positive impact on the world. Their leadership has been instrumental in the success of Alphabet and Microsoft, and they are both role models for other executives who want to make a difference in the world.

In addition to their talent and experience, Pichai and Nadella also share a commitment to diversity and inclusion. They believe that a diverse workforce is essential for innovation, and they have both taken steps to make their companies more inclusive. For example, Pichai has created a diversity and inclusion council at Alphabet, and Nadella has launched a number of initiatives to increase the representation of women and minorities at Microsoft.

Pichai and Nadella are both proof that merit alone can turn a company’s fortunes around. They are also role models for other executives who want to make a difference in the world. Their leadership and commitment to diversity and inclusion are making a positive impact on the technology industry, and they are inspiring others to do the same.

Similar story is that of Tesla which is a publicly traded company, with Musk being the largest shareholder. Although Tesla and Musk are now virtually synonymous, the billionaire did not originally establish Tesla; Marc Tarpenning and Martin Eberhard founded the company in 2003.

Apple is not a family owned company either. The company is publicly traded, and its shares are owned by a variety of investors, including individuals, institutions, and mutual funds. The largest shareholder is Vanguard Group, which owns about 7% of the company’s shares. Other major shareholders include BlackRock, State Street Corporation, and Fidelity Investments.

Apple was founded by Steve Jobs, Steve Wozniak, and Ronald Wayne in 1976. The company was originally a family business, with Jobs and Wozniak owning the majority of the shares. However, the company went public in 1980, and Jobs lost control of the company in 1985. He returned to Apple in 1997, and he led the company to a period of great success. However, Jobs died in 2011, and Apple is now run by Tim Cook and it is one of the most valuable companies in the world.

Perils of a family owned Technology business and the future:

First, technology businesses are often more complex than non-tech businesses. This complexity can make it difficult for family members to work together effectively. Additionally, technology businesses are often more competitive, which can create additional stress for family members.

Second, technology businesses often require a high level of expertise. This expertise can be difficult for family members to acquire, especially if they do not have a background in technology. Additionally, technology businesses are constantly changing, which can make it difficult for family members to keep up.

Third, technology businesses can be volatile. This volatility can make it difficult for family members to plan for the future. Additionally, technology businesses can be difficult to sell, which can make it difficult for family members to exit the business.

However, there are some successful family owned technology businesses. These businesses are often able to overcome the challenges of family ownership by having clear roles and responsibilities for each family member, by establishing strong communication channels, and by having a strong commitment to the business. While there may be some exceptions, the available data suggests that dynasty-based management is not conducive to a technology company’s success.

In case you missed:

- None Found