In the previous two parts of this digital crimeverse trilogy, we highlighted 25 common ways cybercriminals can cheat you while in this Satyen K. Bordoloi tells you of digital hygiene habits to keep both your money and sanity safe.

When Vishal Singh – on a working day in his company in Gurugram – got a message from his boss on WhatsApp, he wondered why the number was different. But the display photo was his boss’s so he didn’t suspect it even when the boss said he couldn’t talk as he was in the middle of a customer negotiation but needed an urgent favour from Vishal: cash. Vishal made 10 PayTM coupons of Rs. 5,000 each as asked by the boss. A little later when he asked for another 10 such coupons, Vishal complied but when the demand was made a third time, Vishal called his boss’ secretary and found his boss was on vacation. A direct call to his boss confirmed that he had just been scammed.

Vishal isn’t the only one. Thousands of people across India – the number is increasing alarmingly and could reach hundreds of thousands – get scammed via digital means every single day. In the first two parts of this series [LINK TO FIRST ARTICLE HERE] we highlighted the most used methods by cybercriminals. Here we will tell you of digital hygiene habits so you don’t find yourself in Vishal’s shoes.

WHAT IS DIGITAL HYGIENE:

Digital hygiene is a set of practices, principles and guidelines to keep your online behaviour and digital devices safe, secure, and healthy. Like personal hygiene keeps your physical body healthy, digital hygiene is meant to protect your digital life from various threats and risks, including computer viruses and maliciousness of those out to scam you.

We start with 10 basic things you can do to keep your digital life safe.

1. Ensure every password for every device or service/account you use is sufficiently strong. If the potential exists, enable a two-factor authentication for extra protection.

2. Keep all your operating systems, apps, and antivirus systems updated with the latest patches that close newly observed vulnerabilities. Always have antivirus software.

3. Download apps or software for your computing system only from known and trusted sources. Pirated software can install viruses or malware.

4. Never click on links in emails, SMSs, social media or websites, or download attachments, if you don’t trust the source.

5. If an online offer sounds too good to be true, it perhaps is. Don’t fall for it.

(Image Created on Bing.com)

6. Be a miser when it comes to sharing stuff online. A 3-second voice sample is enough to clone your voice. Photos of vacations, work, parties etc. can open you up like a book to scammers. But if you must do it, use the privacy setting to adjust who can see your photos and videos.

7. Try not to use public Wi-Fi, but if you have to, use a VPN to prevent interception of your data.

8. Clear browsing history and cookies regularly in your systems (cache of each app in your mobile) to protect your privacy and prevent targeted ads or malware.

9. Regularly backup your important data and files, both online and on an external drive if possible. Due to the vulnerabilities of digital data, something is not said to exist unless it has three copies.

10. Declutter your digital systems by organising your files, emails, photos etc regularly to not only help you be more focused and productive but also ready whenever an attack happens.

Let us now look at how you can protect yourself from specific scams.

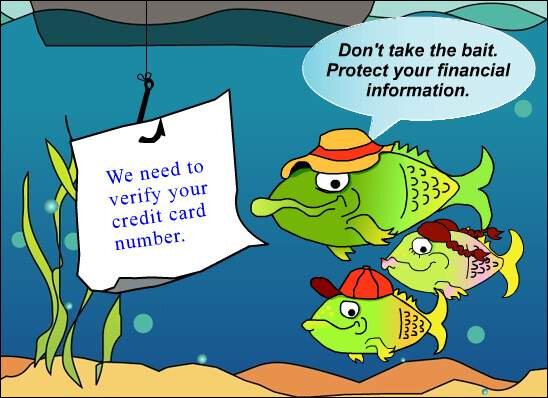

PHISHING, VISHING, SMISHING:

The best protection against phishing and its type is vigilance. Make a rule never to click any link you don’t fully trust. Always be aware of tell-tale signs like bad grammar and spelling mistakes in messages, emails etc. E.g. antiphishing@icicibank.com is an actual ID where you can report phishing attacks while antiphishing@icicibnnk.com, auntiphishing@icicibunk.com or antiiphishing@icicibunk.com, though they look similar, are fake IDs.

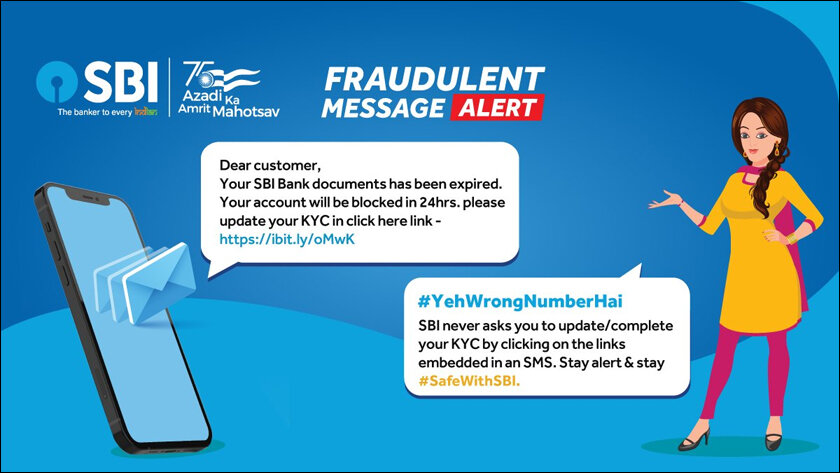

KYC FRAUDS:

“Dear customer, your HDFC Bank account has been suspended for KYC. Please complete the KYC in 10 minutes urgently by clicking this link,” or “Dear customer, Your SBI Bank documents have expired. Your account will be blocked in 24hrs. Please update your KYC by click here link – http://ibit.ly/bOinK“. If you have received such or similar SMS that is not from the source you trust explicitly, know that a KYC fraud is targeting you. As you can see, this fraud relies on urgency, and fear. Your account being shut down could cause complications, so you feel compelled to act. You should not panic or click on the link, but even if you do panic, don’t click the link. Instead, call the official customer care helpline of your bank and check if it is indeed true. Secondly, no banks ask you for specific, personal details that can compromise your security like passwords, ATM pins, card CVV, OTP etc. No matter how much someone insists, never share details you think no one has the right to know.

SEXTORTION SCAMS:

One of the best guards against sextortion is to never take any compromising photos or videos with anyone, no matter how much they insist. If you need to take it nonetheless, cover your face and take nude photos or videos only of your body. A good way to keep yourself alert is to click every photo, believing it will surely end up on the internet. Teenagers and young adults who are not so smart about the world easily fall prey to such things. Guide them into this. However, in case you find an actual nude photo or video of you, or your face morphed with a nude body of another – both used to blackmail you, you should not give in to them because even if you do, their demands will never stop. Remember that what they are doing is a criminal offence and you are a victim. Go to the relevant authorities immediately. The extortion and blackmail will take more from you than dealing with it with the help of authorities will.

AADHAAR SCAMS:

Aadhaar-Enabled Payment System (AePS) is rife for fraudsters to scam you because banking transactions using them do not require SMS or OTP. You can protect yourself by locking your biometrics as a precautionary measure by visiting the UIDAI website, enrolment centre, Aadhaar Seva Kendra (ASK), or through m-Aadhaar.

PYRAMID SCHEMES / INVESTMENT SCAMS:

It is not just simple folks, but even cops and army men who have been ensnared in it. One way to keep yourself safe from these scams is to know just this one fundamental rule of interest: the safest interest on your money offered today is in Fixed Deposits which is around 7% a year, i.e. if you invest one lakh rupees in an FD for a year, it will become one lakh seven thousand. Anyone who comes to you saying they’ll safely double your money in six months, you must consider them frauds from the word go because at 7% the safest legal method FD will take over a decade to do so. Even the very risky stock market can’t double money so quickly unless you get lucky.

YOUR PSYCHOLOGY:

If you had paid attention to the three articles, you’d have observed that most scams involve using your psychology against you. Your anxiety is used to target you. The fear of asking why your boss needs ₹50,000 urgently, can lead you to be scammed. Trying to cheat on your wife via a dating app can open you up to blackmail. If you are looking to better your financial condition with a get-rich-quick scheme, it will be used against you.

When Socrates said ‘Know Thyself’, he unintentionally was also protecting you against cybercriminals because your first line of defence is your understanding of and control of yourself. Working on yourself so you aren’t generally an anxious person. Keep your marriage and relationships honest, even if they are not monogamous. Realise that doubling money in a few weeks is just not possible by legal means unless you invest in a stock that’s shooting up (I do not recommend it).

Like digital hygiene habits, here are five psychological hygiene habits that will protect you from cybercrimes.

1. DON’T PANIC:

Panicking during a crisis is counterintuitive. When you are in the middle of a problem you need to solve, you need all your mental faculty about you. Hence, when you panic, you bypass your reasoning, leaving you open to making mistakes. However, if you can’t help but panic, keep some people who you can contact in such a scenario so you don’t end up making a mistake.

2. DON’T BE AFRAID:

Fear induces panic, and panic can make you do things that make you vulnerable to fraud. If you can develop the habit of remaining calm, of not becoming easy to scare, you build a wall against scammers.

3. PRACTICE IRREVERENCE:

Vishal had red flags tingling in his mind when his boss messaged from another number. But his respect for his boss made him transfer money without checking. Perhaps it is the ‘boss culture’ the boss-is-always-right culture of our offices, that is to blame for this scam. Yet, it is poor Vishal who suffers. Thus, if Vishal weren’t so subservient, and had a tiny bit of irreverence in him, he would have checked despite his boss’s alleged urgency.

4. TRUST, BUT NOT IMPLICITLY:

When in love, people trust others blindly, the other person becomes like a god so when a boyfriend asks for a nude selfie or a video, a woman complies. But having a bit of irreverence against those one loves, and a tiny bit of mistrust, enough to draw boundaries and put one’s foot down, will prevent a lot of future suffering.

5. DON’T BE VAIN:

Social media, especially those like Instagram, are jealousy machines. People want to show their best, happy side. Hence, they post all kinds of things – true or not – to make others jealous. These are enough to give scammers a good window into your life, to know your vulnerabilities and thus where to hit you. Hence, remember foremost that it is the most insecure people who post the most on social media. And insecure people are a delight to scammers. Hence, when it comes to social media, be like Uncle Scrooge is with his money – a miser. Don’t leave a window into your psyche and your life open for a scammer to enter and thus cheat you. How much is too much? I don’t know. If a three-second voice sample is enough to clone your voice, you decide for yourself.

NO ONE IS SAFE:

There isn’t a single person in the world with a digital life, who hasn’t had an attempt made on his money or data. I know because I keep getting targeted every few weeks, over the phone, email, WhatsApp etc. I have got calls from strangers selling things, an urgent call from a ‘lawyer’ informing me a service has been blocked, phishing SMSes and emails, online job offers, crypto money doubling scheme SMSes, Ponzi scheme calls, random missed calls from strange numbers, WhatsApp job messages etc.

How I have survived is by keeping my suspicious wits about me. I not only do not trust strangers; I mistrust them with a vengeance. My phone is tucked deep inside my pocket anywhere there is a stranger around, and I don’t check my phone at all when I am hanging out in public places with friends, choosing to instead observe life and people around. I always enter the password on card machines or ATMs after covering it with the other hand.

Over the years I have also worked on myself, becoming a Zenlike Stoic and not being prone to fear or panic in crunch situations. Besides protecting my digital life, it has helped me put out a few small fires that could have led to larger carnage because I kept calm to extinguish them while people panicked or kept their distance. I give myself the permission to break down and cry after the crisis has passed, not while I am in the middle of it. I have an irreverent sneer ready for anyone and I have zero social media vanity except for one profile photo on LinkedIn and to those who publish my articles, I haven’t shared my photos anywhere and except for people very close to me, no one knows where I go or what I do daily. And even though I have done some crazy stuff that can go ‘viral’, I’ve not shared them. I’d rather be safe than go viral. I hope you do too, because even though cybercrimes in the world are increasing, it is just the start.

With AI today and quantum computing a few years down the line, you won’t be able to take a step in the digital landscape without being targeted by cybercriminals, scammers and fraudsters. So, sharpen your digital katana and khukri Dorothy, ’cause Kansas is going bye-bye!

In case you missed:

- Zero Clicks. Maximum Theft: The AI Nightmare Stealing Your Future

- Digital Siachen: How India’s Cyber Warriors Thwarted Pakistan’s 1.5 Million Cyber Onslaught

- AI Taken for Granted: Has the World Reached the Point of AI Fatigue?

- Black Mirror: Is AI Sexually abusing people, including minors? What’s the Truth

- Kodak Moment: How Apple, Amazon, Meta, Microsoft Missed the AI Boat, Playing Catch-Up

- Digital Siachen: Why India’s War With Pakistan Could Begin on Your Smartphone

- Anthropomorphisation of AI: Why Can’t We Stop Believing AI Will End the World?

- Why Elon Musk is Jealous of India’s UPI (And Why It’s Terrifyingly Fragile)

- Rogue AI on the Loose: Can Auditing Uncover Hidden Agendas on Time?

- The Great Data Famine: How AI Ate the Internet (And What’s Next)