Age and generation gap has a big contribution to phishing attacks

YOU JUST NEED TO CLICK THIS LINK TO GET £100 FOR READING THIS ARTICLE.

If you have clicked on the LINK above, you must read further. Even if you did not, I am sure we can share some nuggets around how to identify and safeguard from Phishing attacks.

‘You owe IRS tax returns, click here to avoid penalty’

‘You have been left an inheritance of 1 million dollars from your relative’

‘Your parcel delivery is awaiting collection at the post office’

These may be familiar statements on your messages, emails, sometimes even physical letters.

You may be thinking you are IT Savvy and you can read through the phishing attacks and are safe. If like me you are smug about this read on.

Age & Phishing

Age and generation gap has a big contribution to phishing attacks. Phishing can also be coupled with phone scamming with leaked information available on websites. As our worlds become increasingly digital, older adults fall victim to ‘phishing emails’. This demographic is largely catching up with the fast-paced moves coupled with COVID and the use of digital methods to avoid cash transfers, demonetisation and various other factors where banks are increasingly supporting use of digital platforms and applications.

Studies have revealed that the suspiciousness of emails are not fully understood.

The baby boomer generation on the other hand are also sometimes highly risk-averse, so any suspicious activity or emails relating to tax evasion or inheritance can be perceived as legitimate, triggering a series of financially adverse actions.

In this rapid-decisioning environment, it can be unnerving for a certain generation to keep pace with the changes they have been subjected to causing a lot of dependency on others right from extending their health insurance, to paying general taxes, exposing them to various data leaks and phishing attacks. The phishing attacks are personal now a days with your names on emails as well.

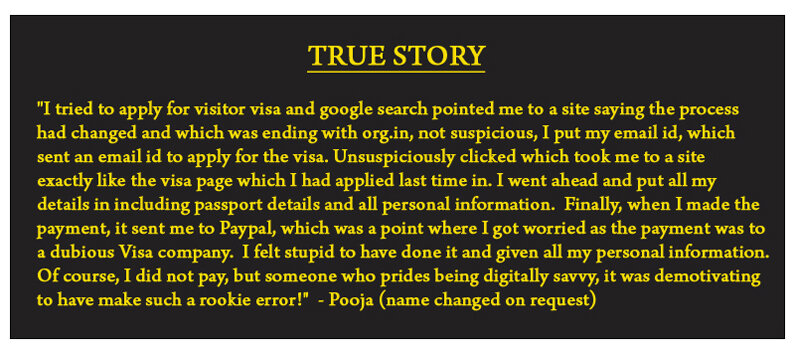

TV anchor Nidhi Razdan disclosed that she had fallen prey to an elaborate phishing scam which involved an offer to teach journalism at Harvard University. Though she was never asked for money, she shared her personal information for a ‘work visa’. With journalist Nidhi Razdan opening about how she was duped by a fake job offer, the spotlight is now on targeted attacks, and why victims don’t come forward. Social media were very quick to pick sides. Nidhi Razdan was brave to openly talk about it even if it was naive on her part to fall for it.

‘Phishing attack traffic skyrocketed to 220% of its pre-COVID-19 rate, exceeding typical seasonal spikes, with attackers exploiting victims’ uncertainties about and fears of the pandemic through a variety of scams, including emerging scam types against which current defenses are not sufficient.’ (Studies report)

Phishing studies have not revealed any gender or specific demographic data to date in the studies done thus far. The reason among many people may be plain over-sight, being busy, managing multiple activities among many others apart from education.

Many of the middle-aged people have enough education from their work environments, banks, social media, friends, etc. However, the phishing attacks are increasingly getting creative and have evolved to align with our day-to-day needs making it less suspicious.

Financial organisations must work with their relevant Conduct and Regulatory Authorities to prove that they are doing enough to educate their customers using test phishing emails in the form of monthly statements, etc.

Teenagers and Young Adults who now have access to credit cards and various social media, it is even more important to educate them on the possible form of attacks. Fraud and Anti-Money Laundering are being taught in schools and universities; however, the discussions need to be encouraged at home as well.

In detail, human wellbeing is a complex ecosystem including emotional and intellectual aspects. Phishing attacks that deceive and take an advantage of human emotions can lead to fear and distrust which in turn leads to isolation and a loss of relationships and lower quality of life (Drevitch, 2021).

The key would be to limit the stigma around the mistakes and empower everyone to know the action to take when an attack happens which may significantly impact ones financial and mental wellbeing.

What can be done about it?

- There is a lot of social stigmas associated with people who have been reported to be affected by these Phishing attacks. Support the affected in the period as it is quite destabilising to lose your lifelong savings or living expenses however small it is.

- Continually educate the individuals on the pitfalls and identifiers with a view on why safeguarding personal data is important.

- Keep talking about it all the time, it isn’t a one-time activity by giving relevant examples. Also, ensure that you have a point of contact for online financial decisions which are out of the normal.

For more information and education material on Phishing, please visit https://www.phishing.org/history-of-phishing

In case you missed:

- None Found

1 Comment

Thank you for sharing the information about phish and true story, it is good article, keep sharing.