Uma Iyer explores the dire prospects that sit in the path of the IT industry in the face of a possible global economic slowdown

With the COVID crisis looming over China once again and a predicted economic slowdown, hard times are looking far from over.

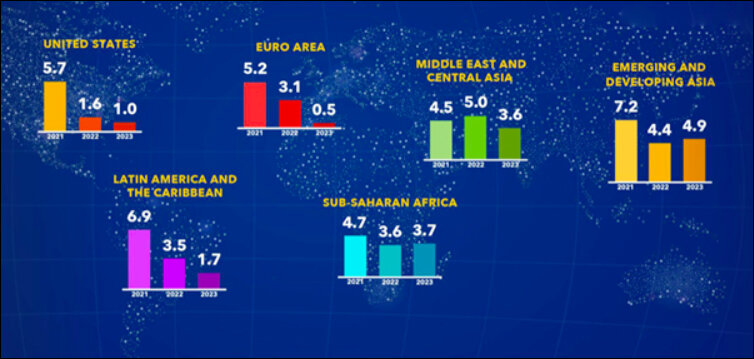

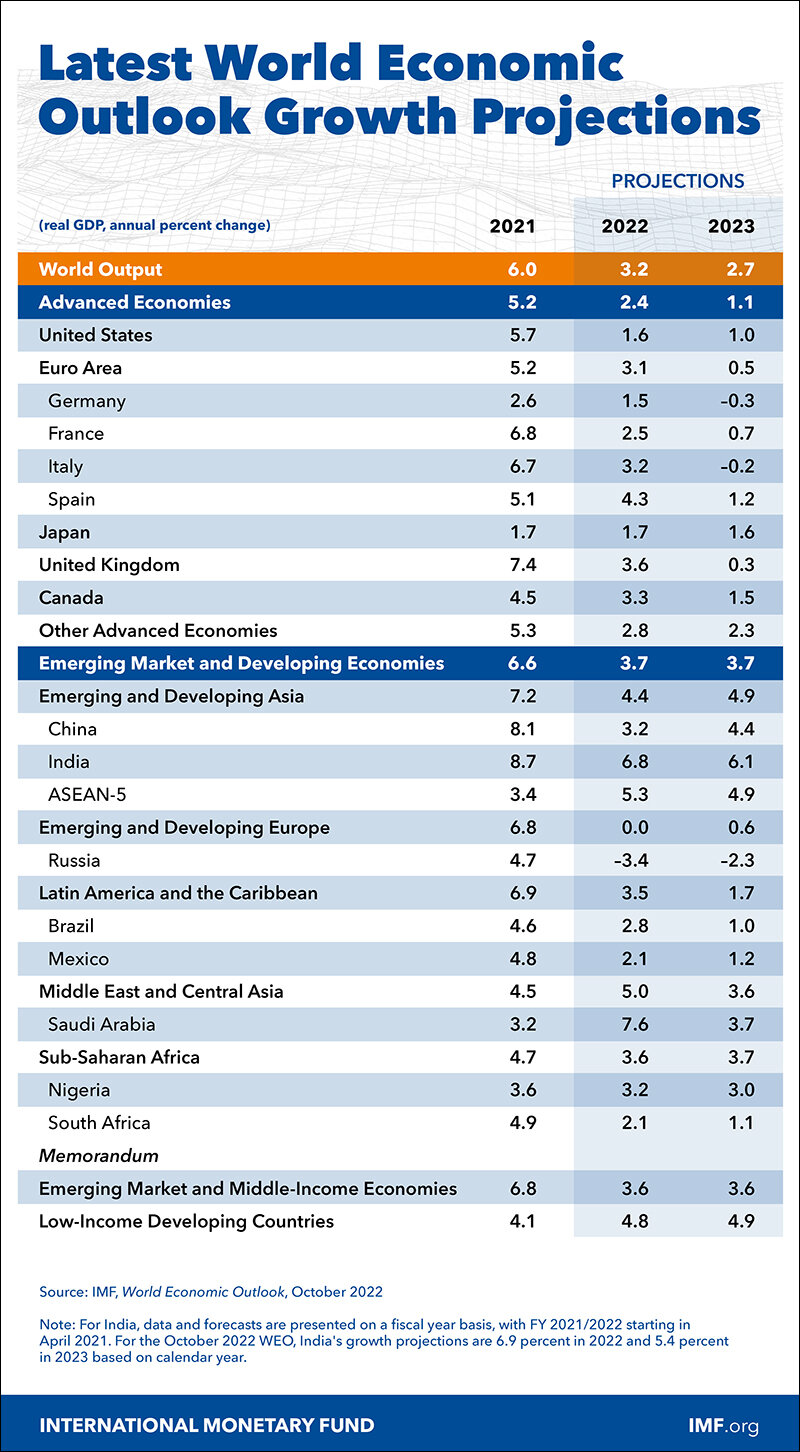

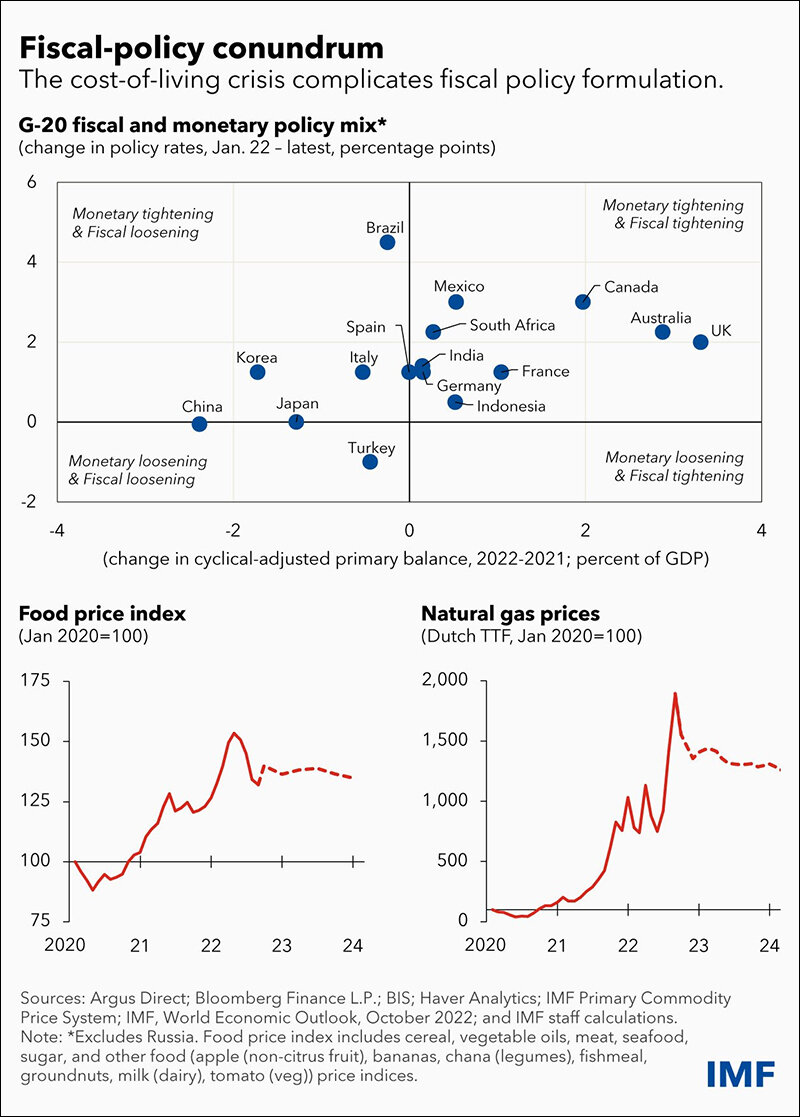

The IMF predicts that the largest economies China, Euro and the United States are slowing down. The worst, however, is yet to come and 2023 will be like a recession. The cost of living crisis has become more apparent.

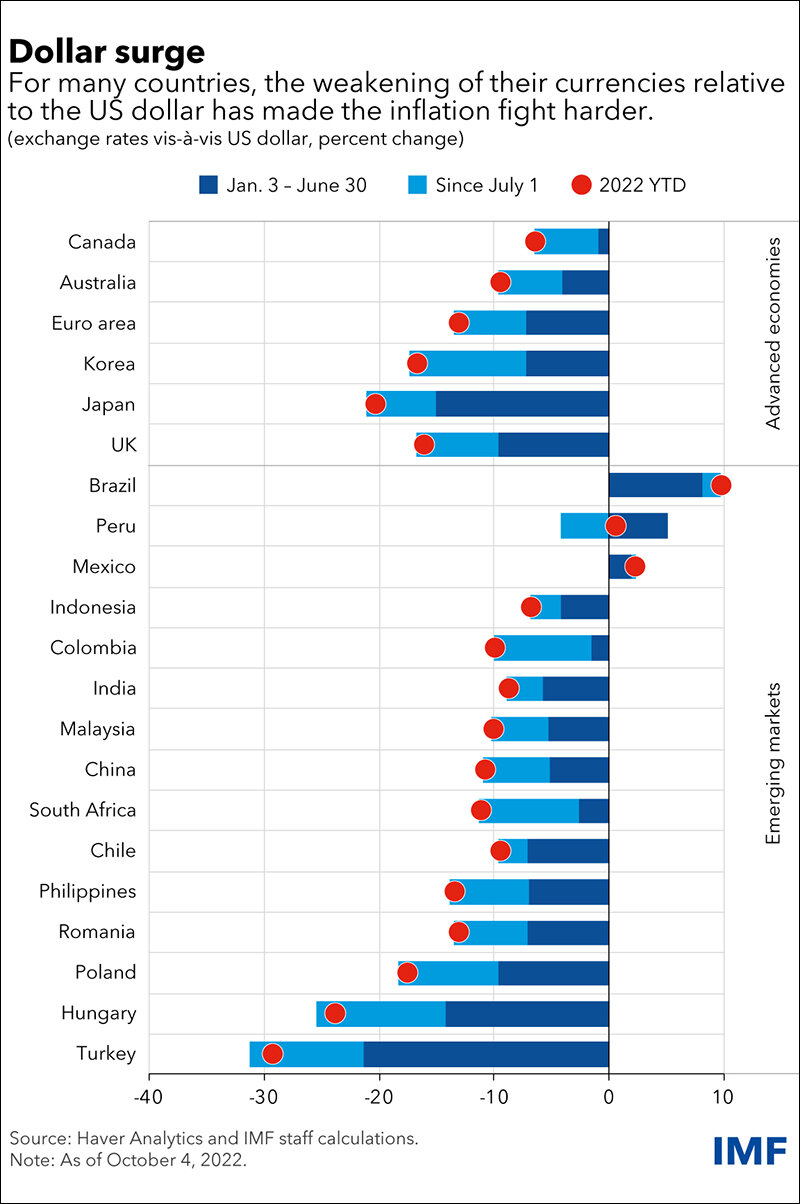

While the dollar strengthens, inflation in the emerging markets and developing countries like India are going to face the pressure! This is going to be further exacerbated by the energy crisis added by the Ukraine war.

What does it mean for India and the developing countries?

India surprisingly is better posed with a very limited slowdown as we can see from the IMF statistics. With the cost of living in a relatively manageable state, India is going to be in a relatively stable position. While the IMF predicts a slowdown to 6.1% it is not as bad as the developed nations. IT generates between 40% to 50% of India’s revenue.

“It was feared that the economic slowdown in Europe and the US would affect the IT sector, but that has not happened. Contrarily, the majority of businesses have reported strong growth, even in Europe. While the situation is volatile, companies are confident of navigating the same successfully.”

The slowdown and its impact in other IT markets

The US economy has been the biggest benefactor of IT jobs and has enjoyed growth and profitability, including Netflix, Meta, Apple, Google, Amazon to name a few. However, the trend for 2022 and 2023 seem to be far less bright; Big Tech giant Meta is predicted to have a 33% decrease in net income followed suit by Google.

‘The rising costs affect businesses directly as they see their overheads soar and also reduce customers’ buying power, which obviously affects sales revenue. For example, recent research shows that there has been a substantial reduction in online advertising sales, especially on social media, which is causing issues for both Meta and Google. Research company Magna estimated that the US digital ad market increased by only 11% in the second quarter of 2022, compared to 58% in the same period last year.’

Impact in the UK

The British economy on the other hand has since tanked after COVID. Brexit coupled with the Ukraine war and energy crisis have had a crucial impact shooting up the cost of living coupled with strikes from NHS, postal services, railways and teachers to name a few demanding salary hikes. While Kwasi Kwarteng, unfunded tax cuts, the pound tanked and Bank of England has been forced to intervene to restore order in financial markets.

While IT spending will be steady, there will be a steady shift to maintain status-quo where possible to ensure that spends are managed. IT may well survive with marginal cuts in comparison to 2021 to ensure that the automation and solutions can help sustain the difficult period. Many of the low key jobs have moved to automated solutions. Cafes have been replaced with vending machines and online sales have increased with limited kiosk-base options.

Kwasi Kwarteng, Britain’s new chancellor of the exchequer, unveiled £45bn ($48bn) of unfunded tax cuts in a radical mini-budget. Since then the pound has tanked, investors have taken fright and the Bank of England has been forced to intervene to restore order to financial markets.

The Economic Slowdown and its impact on the Indian IT industry

The IT industry has suffered more from an attrition rate. While there have been mass layoffs happening in various countries, India seemed to be struggling with retaining employees. However, in view of the global recession, the attrition has seemed to do a tad bit better in Q4 2022.

Milind Lakkad, Chief HR Officer of TCS said, “With supply catching up across the industry, the pressure to poach experienced talent is easing. So, we should start seeing the churn settle in the coming months. Based on the monthly trends, we believe our quarterly annualized attrition figure has peaked in Q2 and should start moderating in the second half.”

While the US is on its way to slow down the budgets, this will show a direct impact on all companies including Infosys, TCS, Wipro, Tech Mahindra to name a few. Many of the companies like Infosys have already posted a decline in the earnings before taxes. Also, companies have really struggled in the past two years with retaining and hiring employees.

In May, it was viewed that over 86% of employees will look for better opportunities. Although it might be a squeeze, India may be able to tide through the period due to tightened interest rates with RBI and commodity imports. As weird as it may be, the slowdown in the west may be a positive. Attrition has been a significant issue and the slowdown in the big techs may signal better availability and employers getting some control over the recruitment process and retain employees effectively. Only time will tell!

In case you missed:

- None Found