Uma Iyer looks at the current state of the IT service industry in India and the challenges faced by the new entrants.

In the past decade, let us begin with naming one big Information Technology giant that succeeded in setting up a service industry in the Indian shores. If it is tough to think of even one, it is time to review the thriving service industry in India and what sustains the big players only!

The Big 5!

Infosys, Tata Consultancy Services (TCS), WIPRO, HCL, Cognizant — all are companies that do not even require their full names while discussing job potentials or service provisioning. These companies have a diverse portfolio to support the variety of requirements posed by service consumers across the world.

Whether it be Healthcare, Telecom, Life Sciences, Finance or any other regulated services, these companies are go-to because of the pedigree they have in the market. A selling point of any resume would be the experience the candidate has in the big ocean of the Tech Service Giants as they mildly refer to. The service industry provisioning in India has been steadily increasing because of the ability to scale up or down depending on the requirements of the various industries.

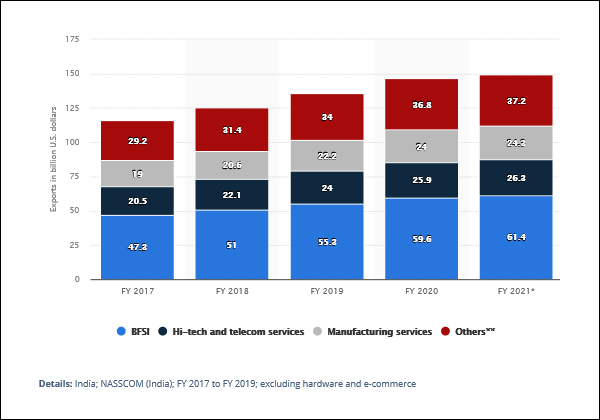

A specific instance would be the COVID immunization drive which was supported by the IT companies where they diverted forces to uplift the tracking of the COVID statistics and boosted the healthcare support from 2020 till 2022. Only major companies could respond to the scalability requirements given access to capital and mobilize the resources. Most of the revenue does come from the US, UK (United Kingdom) and Australia market with US dominating the export with 61.4 billion dollars (about $190 per person in the US) of the total 149.1 billion dollars (about $460 per person in the US) supporting banking, financial and insurance services.

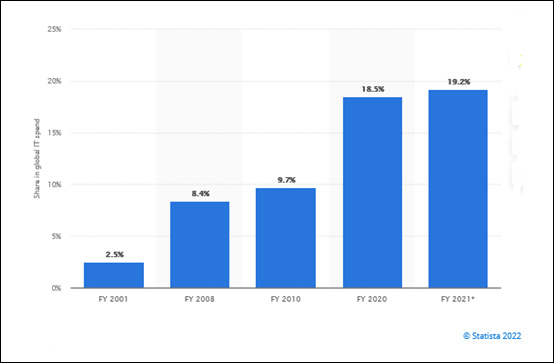

“The Indian IT industry made up to around 19.2 percent of the total global IT spend in fiscal year 2021. There was a constant increase in this value since fiscal year 2001. Furthermore, there was an increased effort from the Indian IT industries to create localization in foreign countries, especially in the United States.”

– Shangliao Sun (Jul 14, 2022)

Why does it work?

In the world dominated by rapid technological change and adoption, ‘people’ have become the most important commodity. It is easier for the top suppliers to get access to modern technology skills, procuring licenses for niche software and invest and train in resources. The big companies can retain the edge in comparison to the new entrants in view of the price point provided to the consumers. The cost of contracts is typically required to show high capital. There is a requirement to show a bigger balance sheet to offset the liabilities often required to be covered as a part of the contracts that need comprehensive indemnity clauses to be signed sometimes to the tune of over 200% of the invoice value.

Given Infosys and TCS were early entrants they benefited from government policies that encouraged the setting up of Special Economic Zones (SEZs). These gave the much-needed real estate and privileges to host over 20000 employees (about the seating capacity of Madison Square Garden) round the clock in towns outside of tier 1 and tier 2 cities building a mammoth city outside the cities with thriving infrastructure. Such options were given to manufacturing industries in the early 70s which now were diverted to the SEZs.

What are SEZs?

SEZs are business parks granted legal autonomy to improve their governance where companies set up within them enjoy unique tax breaks, customized government regulations and different labor and visa laws. ‘ In 1979, there were 200 SEZs. Now, there are more than 12,000.

Governments are spending ever-larger amounts of money on SEZs to cash in – the Saudi Arabian sovereign wealth fund plans to invest $500 billion USD in NEOM, a planned city-sized SEZ. China plans on spending $2 trillion USD on its Belt and Road Initiative, which includes several hundred overseas SEZs.

A study on SEZs indicates that the outsourcing phenomenon was further expanded by many sectors to create opportunities for developing countries like India to give a competitive edge by further liberalizing software export laws and labor adjustments.

The newer entrants however are facing challenges from the established companies to get specialized resources and scaling up in view of the bigger companies.

The Challenge

The biggest challenge faced by many of the new service companies is that of competition within the industry. The margins have significantly increased, and the resources are saturated. While India is at the best phase with a boom in youth, in another 10 years, there will be a decline in the bench strength leading to reduction in the capacity versus the demand which was determined by margins and numbers.

There was margin in volumes, however, that has also now been neutralized as the cost of living across cities in India is at par with any city in UK or US driving up the salary requirements. This in turn influences the margins that the companies enjoyed with the blended shore model.

If you see in numbers, in fiscal year 2022, the number of people working at Infosys amounted to almost 314 thousand while Tata Consultancy Services had 593 thousand employees worldwide, while Accenture has 300 thousand, respectively.

It is exceedingly difficult for new entrants to scale up to the numbers that are currently supported by the big giants while on the other hand, it is also unsustainable for the big companies to support the steady growth projected by the companies in the next 10 years.

What next?

It is especially important for the upcoming IT players and the current players to recalibrate client and shareholder expectations imminently. This will help level the playing field and introduce smaller niche entrants who give specific services.

The big players now must focus on supporting the clients with more quality and less quantity while negotiating better price points. “The most important aspect of the service industry to be moving from a supplier mindset to a partner mindset! ” – says Alok Tripathy in his publication of How to move from Supplier to Partner?

The Venture Capitalists-backed Silicon Valley success stories thrive with fewer but high value customer base. There is a long-term view of the products where monetization is done based on fully understanding the potential of the product and the valuation, not on returns.

It takes a village to build something new. Now the little villages will become the supply industries and become a vital part of the big industry.

One of our favorite Marvel franchises now have niche VFX services provisioning in India, when you see Love and Thunder and are patient enough to stay through for the post-credits, you can see a massive team support which is Mumbai-based or China-based!

There is still hope for the newer companies to ride the wave when the beacons change.

In case you missed:

- None Found

1 Comment

Thank you for sharing the information about Indian it service industry ever stagnate, keep sharing.