The crash prophets have been waiting for their heresy to come true for years, and 2026 will prove them wrong again in this multi-trillion-dollar AI future, writes Satyen K. Bordoloi

As rain goes with an umbrella, clouds with the sky, and a clock with time, if you have lived through 2025, you know what goes with a bubble. Type ‘AI bubble’ in your search bar and you’ll find yourself buried under an avalanche of enough opinions from anxious pundits and gleeful doomsayers to crash a small server farm.

Their chorus is familiar: AI valuations are insane, hype is deafening, so a crash is imminent. They have been singing this same tune since at least 2023. I should know – one of my Sify articles last year, arguing precisely why this crash is a myth, went viral, triggering the annoyance of professional AI pessimists.

Yet, here we are, in 2026. OpenAI did not implode. The trillions did not vanish. Instead, what happened, is happening, and needs to happen more is a great correction. Not a bubble-burst, but a deep, market-wide exhale of some AI stocks that are overvalued. Not enough, but it did happen, and it’s happening still. The dot-com crash was a story of ideas built on air and a few hundred lines of HTML code that sold themselves as startups. Meanwhile, the AI story of 2026 is one of capital building in silicon and steel, and in genuine utility to make both the brick-and-mortar for the AI pipeline and the LLM tokens. The doomsayers are making this millennium’s most expensive error: mistaking the most significant digital infrastructure overhaul for a speculative fantasy.

DotCom’s Ghost in the AI Machine

Prophets love historical parallels. Here, they argue that the dotcom bubble was also fueled by irrational exuberance for a transformative technology – the internet. Hence, AI must follow the same arc. This is a compelling story if you ignore facts.

The dot-com crash was a purge of business models: companies with a slick website, a “.com” in their name, and dreamy PowerPoint presentations, but zero path to revenue. Pets.com sold pet food at a catastrophic loss. Webvan tried to deliver groceries before the logistics or demand existed. They were stories sold to VCs, not services sold to customers. AI in 2026 is the opposite. Only those seeing returns are investing in subscriptions. It is foremost a service for you and me. Although it isn’t generating enough revenue yet, and free tiers are adding to costs, it won’t be long before these are sorted out.

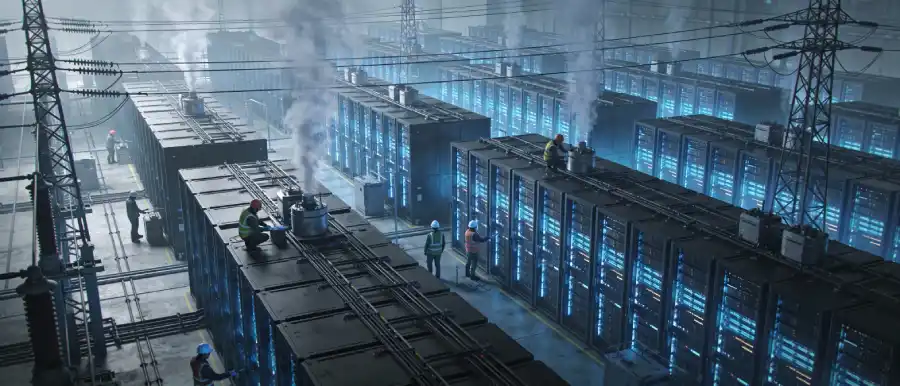

Next, we must remember that first and foremost, AI is a story of infrastructure investment. When President Trump announced that staggering $500 billion investment in January 2025, it wasn’t money to fund a thousand ChatGPT clones. Instead, he was putting the money into power grids, data centres, and semiconductor fabs. This is the critical, boring truth the bubble narrative misses: money isn’t chasing vaporware but is pouring into concrete, and cooling systems, and the most advanced chips ever designed. This isn’t speculation but a calculated, long-term bet on the new electricity of the global economy.

Those like Microsoft, Google, and Amazon – dotcom survivors themselves – aren’t whimsical startups of that age but industrial giants laying down the physical plumbing for the next twenty years – much like the dotcom bubble did actually. A market can “correct” the valuation of a software company in a day – it can’t wish away the existence of a $15 billion data centre, an asset already on the ground, that’ll hum away for the next few decades.

From Hype to Hardware to Human Value

So, what will this “correction” actually look like in 2026? Well, it won’t be a crash but a necessary alignment that will see the AI-washers – the companies that slap AI into everything, which make big claims about AGI with no revenue plan beyond VC funding, the modern equivalents of the 1999 dotcoms, will fall by the wayside. And their failure will clear the ground for a good crop. And the money that flowed easily – like the 70% VC fund in early 2025 going to AI – those will face forensic scrutiny in 2026.

Of course, the real money will move, and be made, in the mundane; away from the headline-grabbing LLMs to the unsexy agentic AI stacks that’ll automate most of our digital work. From AI software that makes your PowerPoint presentation, to a pharma company processing a million digital invoices that saves thousands of human hours – not fun to talk about, but highly effective, and one of the best use cases of AI that’ll only grow in the coming years.

This separating the wheat from the chaff is seeing the rise of companies building real, but dull and unsexy, infrastructure, such as those that make data pipelines, security layers, and evaluation frameworks. Startups solving real business problems, like automating complex back-office workflows or predicting supply chain snafus, are getting real customers and real revenue, but hiccups remain. The hype-fueled “AI-for-the-sake-of-AI” companies are indeed facing challenges; the bubble of their eye-popping valuations is spreading thin and about to deflate. But to say that it is proof that the entire field is made of that is like eating at a bad restaurant, forcing it shut, and declaring the entire concept of food to be a fad.

The underlying drivers for AI are stronger than ever. The pace of fundamental research hasn’t slowed; but accelerated. The problems AI is solving are not diminishing; they are becoming more acute, more numerous. Labour shortages, climate modelling, drug discovery, personalised education – these are not domains for bubbles but are the solid foundations of our future. The capital flowing into those applications isn’t speculative hot air: you can call them strategic investments into the next half century as we move from “AI can do anything” to “AI can do these specific, incredible things very well, and here’s how we implement it.” You can’t call that a crash. Maturity: now that’s the word to use.

Not Winter, Just a Chilly Autumn Evening

AI doomsayers love to invoke the many “AI Winters” tech has seen, which have included periods of funding cuts and disillusionment with the tech. What we must remember is that the previous winters came from broken promises, in which the technology couldn’t deliver even a bit of what it promised. Today’s scenario is the inverse.

The technology is over-delivering, sprinting ahead of our ability to regulate, integrate, ethically manage and even find appropriate uses for it in time. The chill in the air that pundits are calling a winter of disillusionment with AI’s capabilities is but the autumn of responsibility that this technology needs, from which guardrails, governance, and a lot of hard thinking will emerge.

So, no, the AI bubble isn’t going to burst in a spectacular, pop-culture crash. What we will see, and are seeing, is the deflation of the hype bubble. The absurd valuations will correct. The me-too companies will vanish. The conversation will get more nuanced, more boring, and infinitely more important. It will move, is already moving, from “Will this take my job?” to “How do I work with this?” From “Is this sentient?” to “Is this aligned?”

The champagne froth is settling, leaving the actual wine. And let me tell you, from the taste in 2025, the vintage for 2026 looks complex, powerful, and utterly transformative. The future is just getting started. And for those of us who saw it coming, it’s going to be a delightful, if chaotic, ride.

The correction that’s required, hence, is not in the technology, but in the narrative.

In case you missed:

- Why the Alleged, Upcoming AI Crash Is Never Going To Happen

- How Can Indian AI Startups Access Global VC Funds?

- Great quantum poker: Who’s bluffing, and who is holding the aces?

- The B2B AI Revolution: How Enterprise AI Startups Make Money While Consumer AI Grabs Headlines

- Why Elon Musk is Jealous of India’s UPI (And Why It’s Terrifyingly Fragile)

- AI’s Looming Catastrophe: Why Even Its Creators Can’t Control What They’re Building

- The Growing Push for Transparency in AI Energy Consumption

- Would an Electric Plane Have Reduced the Air India Crash Death Toll?

- OpenAI, Google, Microsoft: Why are AI Giants Suddenly Giving India Free AI Subscriptions?

- From Generics to Genius: The AI Revolution Reshaping Indian Pharma