For Indian AI companies to win the world, they need funds like their western counterparts do, says Satyen K. Bordoloi, who attended an open talk about just that.

Many believe technology grows a nation. However, for technology to grow, it requires state patronage and funding. Therefore, if India were to take its rightful place in the global AI landscape, the government would need to get on board first. Thankfully, much before a DeepSeek level deep defibrillator jolted our government into action, they had, last year itself, announced over ₹10,000 crore to be spent on AI.

That is well and good. However, along with that, what this nation needs is funding for its startup ideas.

That is where Mr O.P. Singh, co-founder and CEO of the angel investment firm Cogniphy, USA, comes into the picture with his Bharat-focused fund for AI startups. On a rain-soaked Sunday afternoon of October 26, in the IIT Bombay campus, he was introduced by the eclectic and perennially energetic host, Professor Sandesh R, who organises jampacked IIT-Bombay AI Meetup every few months, as “founder of Cognify, a $25 million AI-focused angel fund focusing on Indian startups” headquartered in Houston, Texas but dedicated exclusively to Indian startups.

Mr Singh enthralled a rapt audience with some practical advice for accessing global funds for their local companies. He provided an authoritative roadmap for navigating this dynamic funding landscape, drawing on his own decades of experience and offering fresh examples of successful investments. He drew a roadmap for how Indian founders can tap into global VC pools and scale their innovative enterprises for worldwide impact.

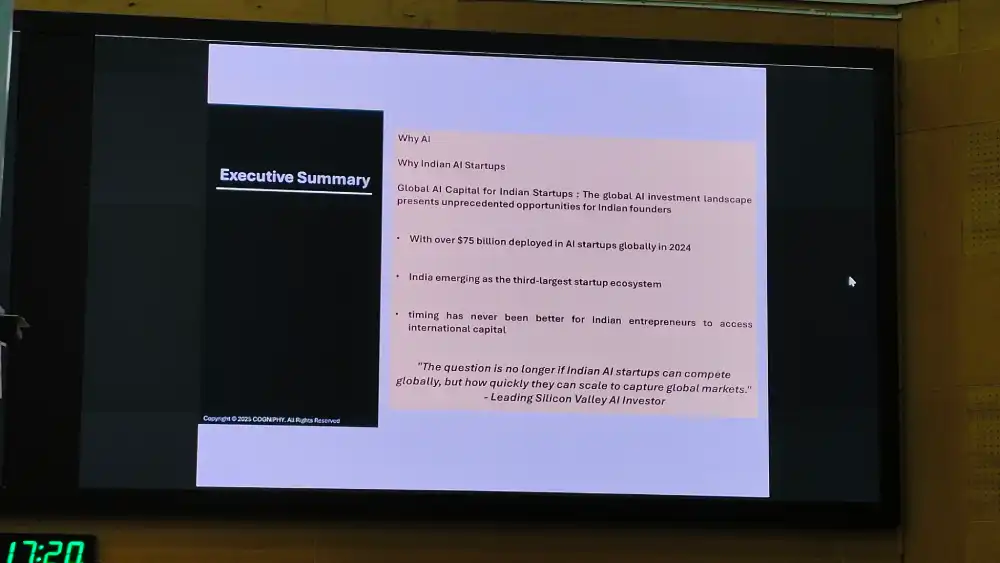

EVERYONE WANTS TO FUND INDIAN AI

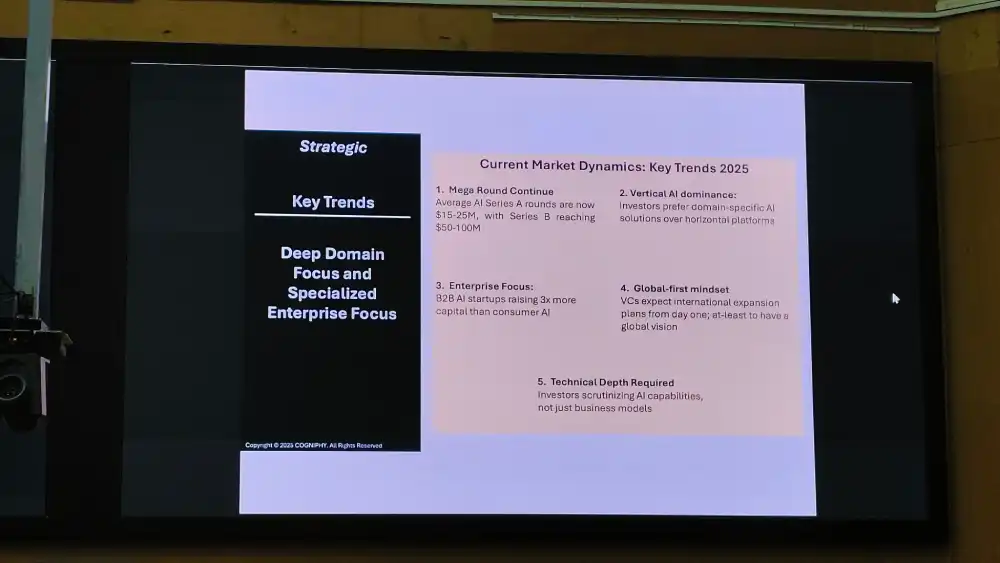

His first contention was that everyone in the VC world, and their uncles, wants to fund Indian AI startups. India’s artificial intelligence startups are poised for a global funding revolution amid a surge of venture capital (VC) interest from leading markets, including the United States, Europe, and Southeast Asia. Hence, he cautions founders against merely viewing themselves as a domestic story and emphasises the need for them to adopt a “global-first mindset” – one that transcends local boundaries and aligns with international standards. Every week, he says, funders like Cogniphy and similar funds assess hundreds of startup ideas, signalling immense investor appetite conditioned by strict benchmarks of innovation and execution.

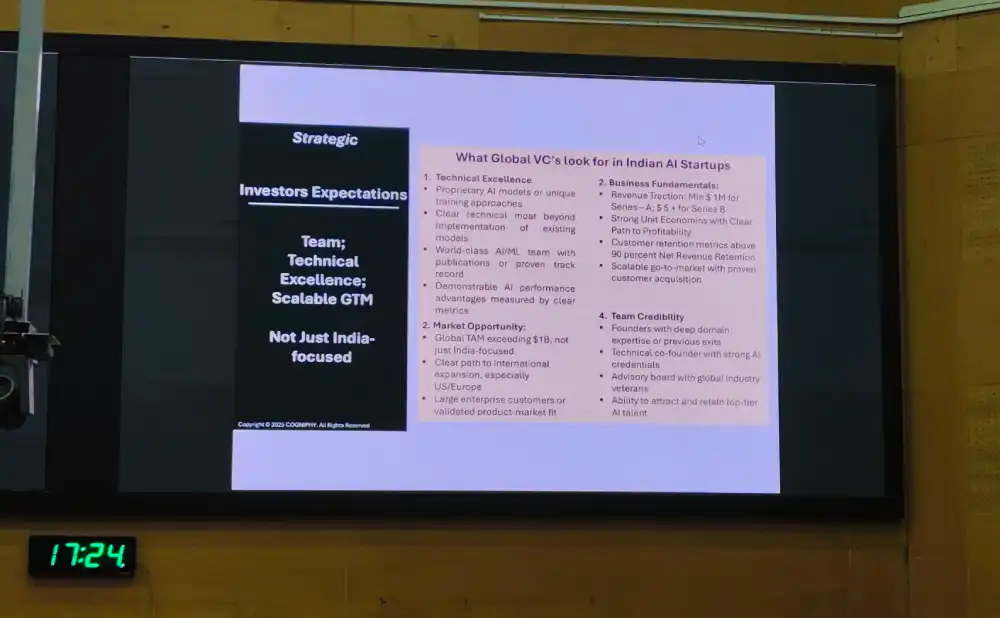

However, his position is clear: global VCs prefer domain-focused AI companies, i.e., those with deep domain expertise and vertical solutions rather than a broad, horizontal platform. He contends that investors scrutinise not just business models, but also the AI engine that powers a startup. For example, niche healthcare, defence, or enterprise AI applications are more likely targets for significant VC backing over generic consumer apps.

Another key point he made was that B2B AI startups have a distinct edge, raising on average three times more capital than consumer AI ventures. Startups addressing enterprise workloads, automation, and infrastructure enjoy more robust support since their solutions tend to be scalable, industry-defining, and capable of global expansion.

Mr Singh discussed something that everyone looking for investments should already know: investors fund individuals more than they do ideas or companies. Hence, a credible, deeply skilled team is absolutely vital for helping global funds decide to invest in the startup. Past exits, technical AI credentials, and a strong advisory board – often with ties to premier institutions like IITs – are highly valued. The ability to retain talent and foster a sustainable culture is what sets apart winning companies in the startup space.

BUILDING FOR THE GLOBAL MARKET

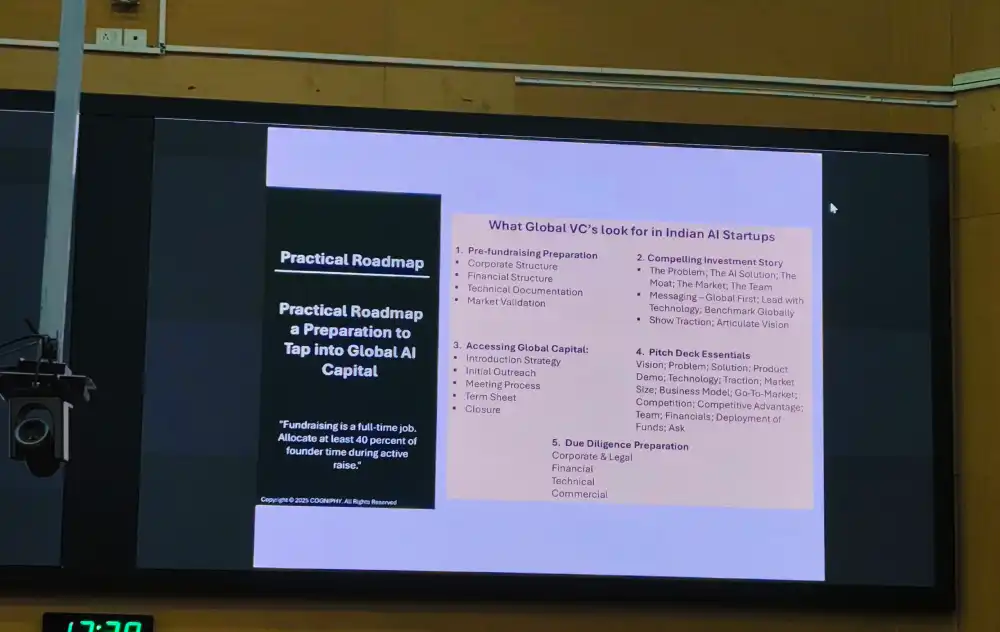

A key stumbling block for Indian startups seeking overseas VC money is a failure to build a global-ready business infrastructure. Mr Singh recommends structuring as a US Delaware C Corp for optimum credibility and compliance. Accounts must adhere to US GAAP or IFRS, not Indian standards, and audits by Big 4 firms are often required, he emphasised.

The other key aspect he highlighted was that when seeking global funds, Indian intellectual property registration will not suffice; global IP protection is crucial for startups pursuing international expansion. Just as vital is market validation, i.e., traction with customers beyond India’s borders – the more diverse and credible your client testimonials, the likelier the funding success.

According to him, global VCs typically expect $2 million in annual revenue at Series A and $5 million in revenue at Series B, particularly for startups outside Silicon Valley. While some pre-revenue companies in the US do get funded, Indian startups are generally expected to demonstrate real sales and market presence before securing large overseas rounds.

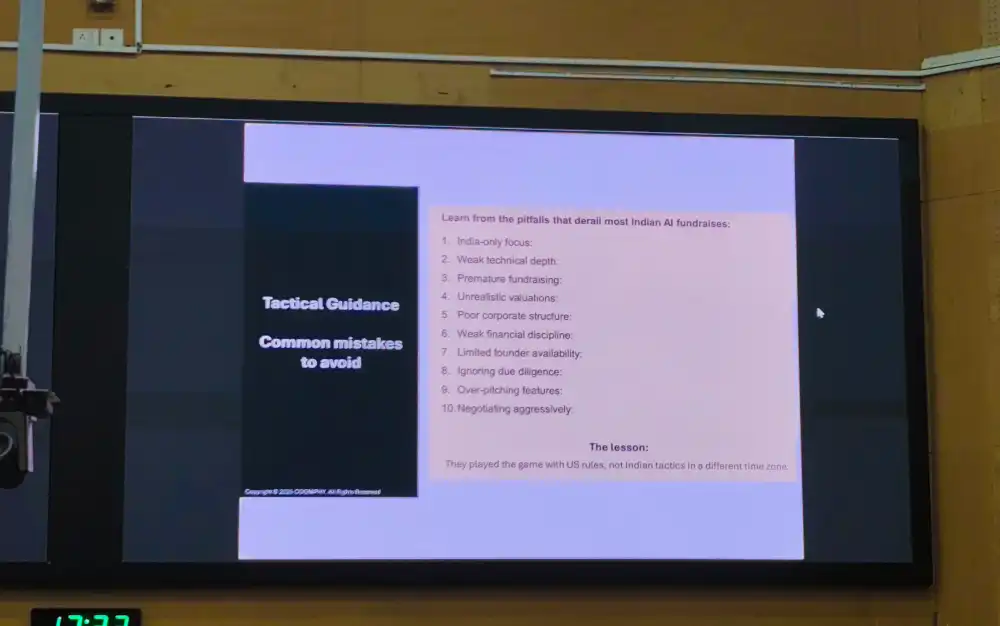

He also highlighted a few, which seem to be personal pet peeves, hence complaints of most funders, to avoid.

- India-only focus: Limiting the product to domestic markets shrinks the scope for global funding.

- Limited founder availability: VC pitch events must showcase the entire founding team, not just the CEO.

- Unprepared documentation: Whether it’s technical architecture, compliance, or IP records, a lack of thoroughness derails pitches and thus the possibility of funding.

- Taking calls from cars: Virtual meetings dominate, but professionalism and commitment must be evident even in virtual settings, as Mr Singh revealed, citing cases of founders pitching from vehicles, which hurt their chances.

UNIQUE STRENGTHS OF THE INDIAN ENTREPRENEUR

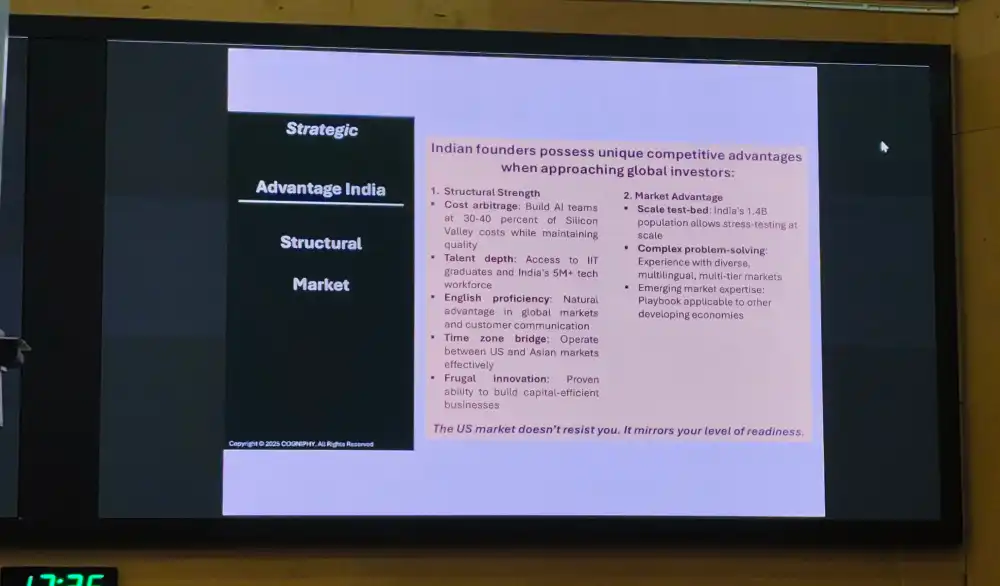

Hailing from the rural hinterland of Baliha, Bihar and having funded 40 local Indian startups while living and working in the US, he is gung-ho about the Indian entrepreneurial spirit. He says that despite the high entry barriers as mentioned above, Indian founders do wield compelling advantages on the global stage.

The first and foremost, he believes, is resilience and persistence. While US founders who may give up quickly, he says, Indian entrepreneurs exhibit extraordinary tenacity – “never give up” is their superpower. The second is what all of us in India are aware of – frugality. We have learnt to operate leanly and achieve more with less, i.e. Indian startups excel at cost-effective scaling.

For the third point, he turns to why he calls his fund a Bharat-focused fund. He says that with a population of 1.4 billion, India remains an underserved AI market. However, this also presents an opportunity: products that work here, having been validated in India, offer tested robustness for global deployment. I have always maintained that if self-driving cars work on Indian streets, they’ll work throughout the globe.

Another crucial point is the presence of a diverse talent pool. As a nation, we produce a vast number of AI-trained engineers who power innovation worldwide. Want proof: check out the CEO’s of Google, Microsoft, IBM, Adobe, Perplexity, etc. The question for all of us should be simple: how do we empower Indian brains in India so that they don’t empower another country over ours?

INDIA IS IN ITS VILLAGES, SO IS ITS AI

When an audience member asked if not being in a metro is a disadvantage, Mr Singh pointed to his own rustic origin and the fact that many of the startups he’s funding come from rural India, solving unique Indian problems.

He said that Cogniphy’s Bharat-first philosophy targets tier 2 and tier 3 cities and supports founders with limited access to traditional pitch environments. Language is not an obstacle, he said; in fact, several portfolio companies feature founders who pitch only in Hindi, yet secure significant investment due to product quality and technical depth.

A notable evolution in VC funding is the rise of virtual deals, with Mr Singh disclosing that out of 40 startups funded by Cogniphy, he has met only four founders in person. This remote-first approach opens doors for entrepreneurs countrywide, including those from rural areas and non-English-speaking backgrounds. Product readiness and AI capability matter more than geographic or linguistic barriers, he believes.

Regarding technological obsolescence, he agreed with the concept because most solutions lose relevance within 18 months these days. So, he says, startups must remain agile, consistently evolve, and avoid complacency once funded. Building a team, maintaining global partnerships, and constantly learning are ongoing requirements for survival and success.

Drawing on examples from his own investment portfolio, O.P. Singh provided illustrations of successful startups, such as InDrones and Constance AI, which exemplify successful investment stories. They became names after demonstrating deep domain focus, global partnerships, and enterprise traction, while also retaining core Bharat-driven innovation. In agritech, he discussed platforms like Sids Farm and Khet Khalihaan, which demonstrate the reach of AI and tech into dairy and agriculture, riding a wave of funding from domestic and international backers.

Securing global VC funds might seem an ambitious goal. Still, it is attainable for Indian AI startups when founders align with international expectations for technical excellence, compliance, maturity, and business scalability. The Indian advantages of tenacity, frugality, market size, and a rich talent pool set us apart compellingly when leveraged through a global lens.

However, to achieve this, the product must not only be AI-enabled—it must solve real problems, be led by a coherent and credible team, and have the ambition to impact beyond India. Along with that, documentation prepared from a global perspective, setting up global-ready entities, building international partnerships, and maintaining a focus on continuous improvement should set the Indian startup apart.

The local is global, i.e., glocal, was a mantra I heard frequently at the beginning of the new millennium. Listening to O.P. Singh, I came away convinced that it is also the mantra for the Indian AI startup seeking global funds. The future belongs to startups that think globally, build locally, and pitch for impact.

In case you missed:

- How India Can Effectively Fight Trump’s Tariffs With AI

- OpenAI, Google, Microsoft: Why are AI Giants Suddenly Giving India Free AI Subscriptions?

- From Generics to Genius: The AI Revolution Reshaping Indian Pharma

- The Great AI Correction of 2026: Why the ‘Bubble’ Popping Could be the Sound of Growing Pains

- The B2B AI Revolution: How Enterprise AI Startups Make Money While Consumer AI Grabs Headlines

- Why the Alleged, Upcoming AI Crash Is Never Going To Happen

- AI Washing: Because Even Your Toothbrush Needs to Be “Smart” Now

- Why Elon Musk is Jealous of India’s UPI (And Why It’s Terrifyingly Fragile)

- The Growing Push for Transparency in AI Energy Consumption

- A Small LLM K2 Think from the UAE Challenges Global Giants