Like between siblings, where one is popular while the other does the grunt work, Enterprise AI is emerging as a winner in the big basket of AI finds, Satyen K. Bordoloi

Somewhere in a materials science lab in Silicon Valley, an enterprise AI system just designed its 41st novel compound in the time it takes most of us to finish our morning coffee. Meanwhile, at a Mumbai law office, another AI assistant just helped reduce contract review time by 85% saving hours of tedious work. And deep in a Chennai hospital, doctors are consulting an AI chatbot trained on five million medical papers to make better clinical decisions in seconds.

Ever since the LLM revolution, starting with Dall-E and then ChatGPT, AI has grabbed attention. But it has almost always been generative AI, even as the AI that came before LLMs is winning Nobel Prizes (DeepMind) and as enterprise AI is redefining what machine learning means for all of us. And best of all, it is doing all this away from the limelight.

In this, the companies leading the charge in enterprise AI are a new breed of AI companies quietly building the picks and shovels of the artificial intelligence gold rush, targeting the decidedly unglamorous but enormously profitable world of B2B enterprise applications. These startups aren’t trying to be viral on social media. Instead, they’re chasing revenue, deployment at scale, and the kind of enterprise contracts that make venture capitalists smack their lips.

And the numbers back them. AI startups captured over half of all venture funding in 2025 – a historic first – with enterprise adoption playing a major role in that surge. Almost every enterprise AI sector was basking in the sun. Here are just thirteen of them.

MATERIAL SCIENCE

Take Periodic Labs, the startup that emerged from stealth mode in 2025 with a jaw-dropping $300 million seed round. Founded by former researchers from OpenAI and Google Brain, their focus isn’t a better chatbot, but using AI-driven simulations, robotic wet labs, and LLMs to discover new materials like superconductors. Their platform combines computational modelling with physical experimentation, generating novel data that feeds back into their AI systems.

While specific partnerships haven’t been disclosed, their approach and the fund they’re attracting point to a shift toward AI that builds, not just talks.

HEALTHCARE

In October 2025, OpenEvidence, dubbed the “ChatGPT for doctors”, raised $200 million at a $6 billion valuation, nearly doubling its worth in just three months. The platform is trained on peer-reviewed literature and provides AI-powered medical search and decision support. The service is free for verified clinicians through an advertising-supported model, and its usage is growing among US doctors.

LIFE SCIENCES

In October, Anthropic launched Claude for Life Sciences, its first formal vertical AI offering. The platform integrates with tools like Benchling and PubMed, enabling researchers to conduct literature reviews, analyse omics data, draft regulatory submissions, and develop hypotheses all within their existing workflows. Pharmaceutical leaders, such as Sanofi and Novo Nordisk, have already adopted the platform. Anthropic reports that tasks that once took days now take minutes, signalling a fundamental shift in how scientific work gets done.

LAW

Harvey AI, founded in 2022 by a former law firm associate and a DeepMind researcher, hit $100 million in annual recurring revenue by August 2025. It serves over 500 enterprise clients, including many AmLaw 100 firms. In May, they raised $300 million in Series E funding, reaching a $5 billion valuation. Its success stems from deep integration into legal workflows, custom model training, and enterprise-grade security. While performance metrics vary by client, Harvey is widely credited with accelerating legal research and contract review, and they’re not the only one.

The broader legal tech sector is experiencing a surge in AI adoption, with startups such as Eve and Filevine also attracting significant funding. This marks a significant shift from an experimental to an essential tool in professional services.

AGRICULTURE

Agriculture, one of the world’s oldest industries, is undergoing its own AI-driven boost. Companies like Niqo Robotics, Arugga, and Bonsai Robotics are embedding AI into farm machinery to automate labour-intensive tasks like spraying, thinning, and pollination, while those like Solinftec, Fasal, and Fieldin are building centralised AI platforms that integrate sensor data, equipment telemetry, and satellite imagery to guide irrigation planning, pest forecasting, and yield tracking.

These aren’t futuristic concepts, or even prototypes, but models that are deploying solutions on the ground to help farmers make better decisions, reduce chemical use, and increase productivity.

MANUFACTURING

Computer vision systems are transforming how we conduct quality inspection, predictive maintenance, and worker safety in factories worldwide. Tractian, a leader in AI-driven asset monitoring, has raised $165 million to date and now serves over 1,000 industrial plants. Its platform predicts equipment failures, automates work orders, and helps reduce downtime. Deloitte reports that AI-powered digital lean transformation can significantly improve productivity and cost efficiency.

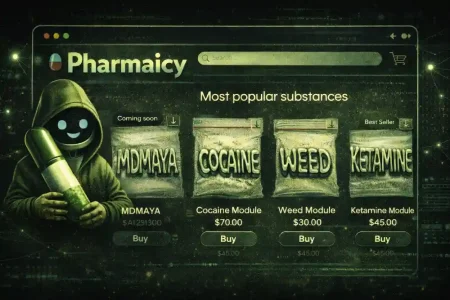

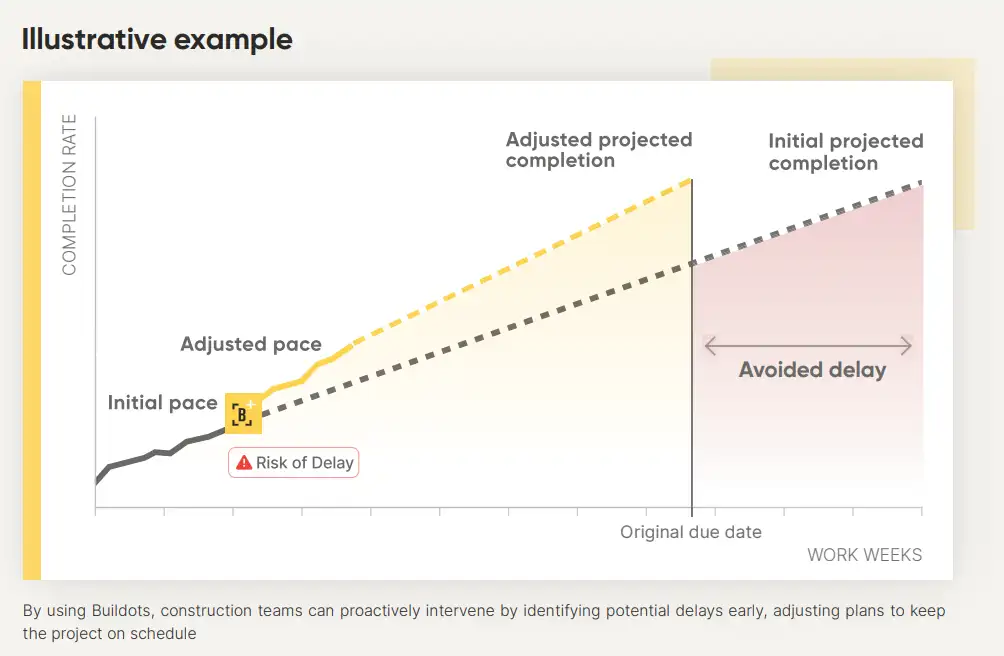

CONSTRUCTION

The construction industry is also embracing AI to plug long-standing inefficiencies that cost money. Buildots raised $121 million to provide AI-powered progress tracking via computer vision, helping construction teams reduce delays. They achieve this by comparing 360-degree site imagery with project schedules and BIM models to identify discrepancies and track progress without relying on manual checklists.

Building Radar secured $7.2 million to deploy AI into construction sales workflows, to help teams identify leads and automate outreach. These companies are demonstrating how even traditional industries can be transformed when AI solves real operational pain points.

CHIP DESIGN

ChipAgents raised $21 million to bring agentic AI to semiconductor design and verification, claiming an 80% boost in productivity and compressing multi-week workflows into days or minutes. The company achieved a 97.4% pass rate on NVIDIA’s VerilogEval benchmark, outperforming models from UC San Diego and NVIDIA. Other startups like Chipmind provide AI agents that autonomously handle complex chip design tasks, while Maieutic Semiconductor use gen AI to automate analogue chip design.

DRUG DISCOVERY

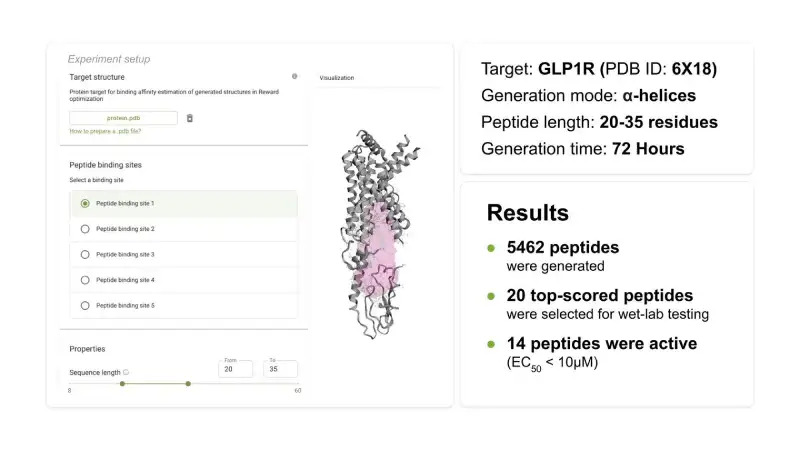

Insilico Medicine’s AI-discovered drug candidate for idiopathic pulmonary fibrosis became the first entirely AI-designed drug to enter phase 2 clinical trials in June 2023. The company raised $110 million in Series E funding in 2025. Recursion Pharmaceuticals, with its end-to-end AI operating system and high-throughput robotic experimentation facilities, has built one of the largest proprietary biological and chemical datasets in the world, spanning 65 petabytes.

While Chemify and CuspAI are also pushing boundaries in molecular and materials discovery using AI.

LOGISTICS

The logistics and supply chain management industry, plagued by inefficiency and opacity, is also being reimagined by AI. Dexory, a leader in warehouse robotics and real-time analytics, raised $165 million to expand its AI-powered platform across global markets. Its technology helps optimise inventory management and warehouse visibility.

Other startups in logistics automation, such as HappyRobot and Augment, have not only generated interest but also attracted VC funding.

FINANCIAL SERVICES

The financial services industry faces the challenge of managing massive data volumes and complex regulatory requirements. It became the perfect segment to adopt AI for fraud detection, risk management, and customer service. McKinsey estimates that generative AI could add between $200 billion and $340 billion annually to global banking revenues through productivity and automation.

Banks are using AI to streamline fraud detection, risk management, and customer service, while automating document validation, reconciliation, and KYC processes to cut costs and enhance compliance. While adoption is accelerating, specific revenue impact figures vary across institutions.

INSURANCE

Insurance companies are deploying AI across underwriting, claims processing, and fraud detection. A Nordic insurance company automated 70% of its claims processing tasks, resulting in faster turnaround times and lower operational costs. Nationwide, Allstate, Progressive, and State Farm have all integrated AI-powered systems to improve efficiency, detect fraud, and enhance customer satisfaction.

Clearcover utilises generative AI to settle claims in as little as seven minutes, with an average resolution time of 30 minutes. Insurers embracing intelligent automation are realising that AI won’t just reshape risk assessment and customer experience, but cut costs and transform operations altogether.

CLIMATE TECH

Climate tech, fuelled by explosive energy demand from AI data centres, is experiencing renewed investment. Global funding reached $56 billion in the first three quarters of 2025, already surpassing 2024’s total. Commonwealth Fusion Systems has raised $863 million, backed by NVIDIA and Google, to advance its fusion energy platform. Brookfield and JPMorgan have pledged multi-billion-dollar investments toward clean energy.

As AI’s power appetite grows, investors are pouring capital into renewable optimisation platforms, carbon capture, and climate analytics: turning infrastructure strain into an opportunity for both innovation and profits.

The common thread in all these is simple: they are solving practical, often expensive, and mission-critical problems for clients who thus see value and are willing to pay a premium for the solutions on offer. The chase for these companies is not virality or ad revenue; they’re building products that increase revenue for their clients, reduce costs, ensure compliance and deliver measurable returns on investment. Many of them are generating millions in revenue, compared to the LLMs that are burning exponentially more cash than they are generating. They are not science projects, but actual businesses.

The distinction between consumer-facing AI and enterprise AI is growing wider and wiser because the latter is focused on ROI, driving efficiency, compliance and innovation, not entertainment or casual use. Value over hype is their mantra, and in doing so, they are revolutionising not just the AI space in general but remaking the world as we know it by powering the next gen of human progress.

In case you missed:

- How Can Indian AI Startups Access Global VC Funds?

- From Generics to Genius: The AI Revolution Reshaping Indian Pharma

- The Cheaper Than Laptop Robot Revolution: How China’s Unitree Just Redefined Our Future

- How India Can Effectively Fight Trump’s Tariffs With AI

- 95% Companies Failing with AI? An MIT NANDA Report Misread by All

- Great quantum poker: Who’s bluffing, and who is holding the aces?

- The Growing Push for Transparency in AI Energy Consumption

- OpenAI, Google, Microsoft: Why are AI Giants Suddenly Giving India Free AI Subscriptions?

- Why the Alleged, Upcoming AI Crash Is Never Going To Happen

- Why is OpenAI Getting into Chip Production? The Inside Scoop