Many have made it their business to predict the AI bubble burst. But an analysis of computing history should make it abundantly clear why it is never going to happen in the way they predict, writes Satyen K. Bordoloi.

At the AI doomsayers market, two types of wares are for sale. First warns of the ‘Terminator scenario’: AI becomes so intelligent that it tries to kill us all. The second: AI valuations are so overblown, it’ll take down the market when it blows and the world along with it. The second seems more reasonable as numerous experts argue AI is overvalued and overhyped.

They compare AI company valuations to the dot-com bubble of the early 2000s that wiped away trillions. They have a point: the capital injected into AI infrastructure is mind-bogglingly enormous. Yet those with the money: AI companies, banks, venture capitalists – even governments, aren’t even putting a feather on the brakes.

The obvious question to ask is: Do they know something the bubble-bursting brigade does not? The answer is something I have been writing about for five years, but it remains a whisper amidst the fear-mongering. So let me start at the end: What many call the AI ‘bubble’ is not a bubble at all. Secondly, the dot-com market crash taught us what kind of companies cause a market bubble. And crucially, yes, these investors do know something that makes them believe AI isn’t going to crash and burn.

Before we understand what that is, let me start with some facts that’ll make a bubble seem imminent.

THE AI ‘BUBBLE’

On the second day of his inauguration this January, President Trump announced one of the biggest projects in American history: a staggering $500 billion investment in AI infrastructure. That announcement followed a trend of large-scale investment in AI, which has been unprecedented since the pandemic.

Global AI spending is forecast to reach $1.5 trillion in 2025 alone, according to Gartner: one of the most rapid capital accumulations ever witnessed. Corporate AI investment reached $252.3 billion in 2024, with private investment climbing 44.5% from the previous year.

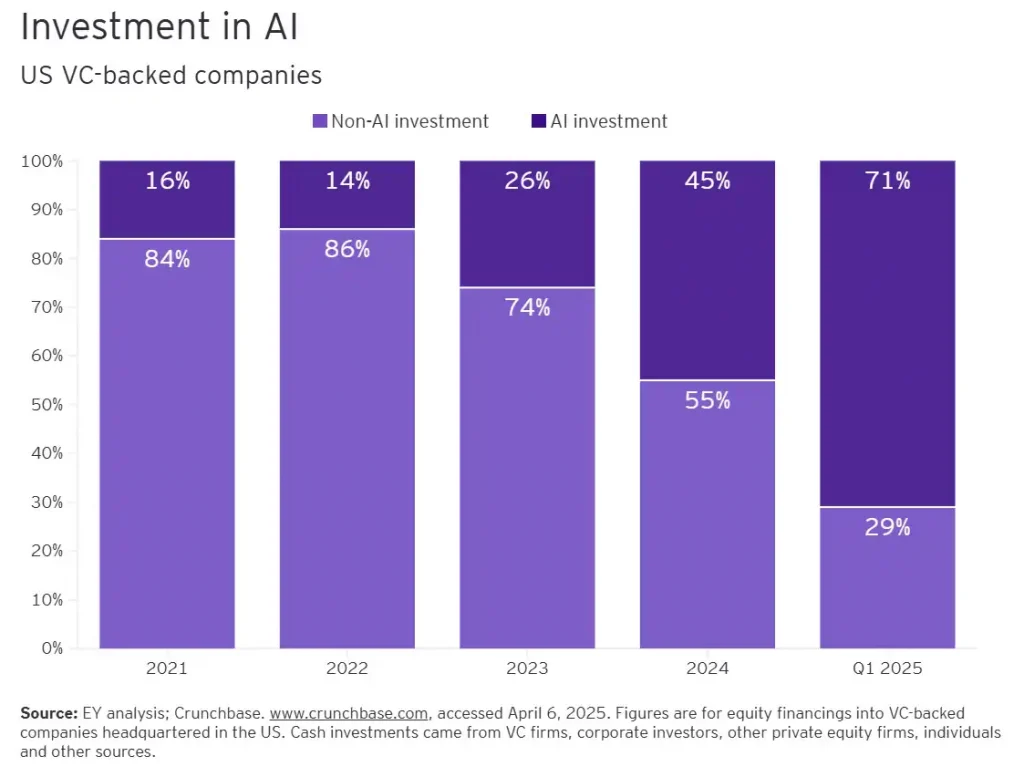

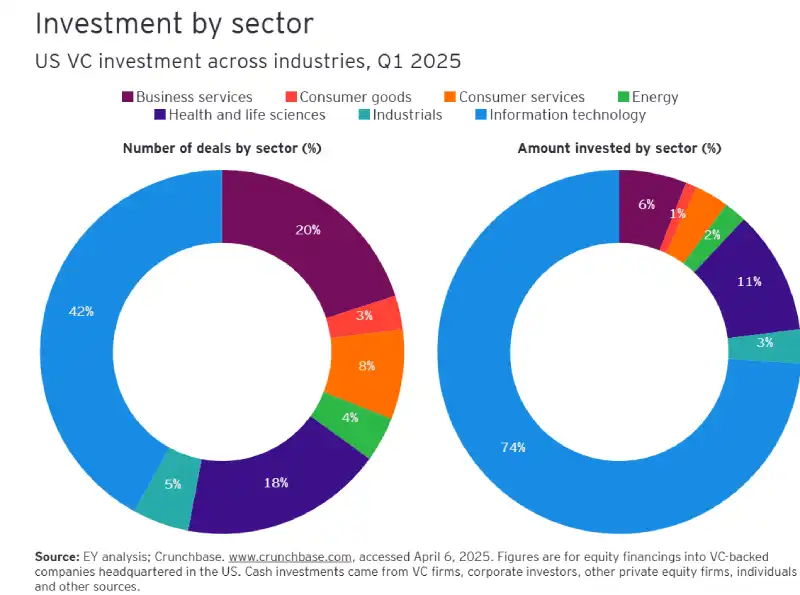

Venture capital has been particularly concentrated in AI, with 48% of global funding year-to-date invested in AI-related companies, including record-breaking deals like the $40 billion OpenAI investment.

When you compare these numbers to historical mega-projects, AI investment dramatically surpasses even the most ambitious human endeavours. The proposed $500 billion “Stargate” project alone would dwarf the Manhattan Project ($30 billion in today’s dollars) and the Apollo Program ($180 billion) combined.

America’s largest infrastructure project, the interstate highway system, cost approximately $500 billion in inflation-adjusted dollars over several decades. AI infrastructure investment is approaching similar magnitudes in just a couple of years. Individual companies, such as Microsoft, Meta, Google, AWS, and Oracle, are committing tens of billions of dollars annually to AI data centres and computing infrastructure.

To many, it would seem obvious: AI is a bubble ripe for bursting. Here’s where you’d be missing the forest for the trees.

THE DOT-COM BUBBLE

The dot-com bubble was a massive investment surge in internet-based companies from 1995 to 2000. Total venture capital investment in 2000 reached a record $103 billion, a 73% increase from the previous year. Much of this money flowed into companies with unproven business models and speculative valuations. The bubble burst in March 2000 when reality caught up with speculation, causing numerous startups to fail as their business models were fundamentally unsustainable.

Even adjusted for inflation, you can see how big the AI investment is compared to this. While we talked billions in the late 1990s, today trillions are at stake. So why do I still refuse to call AI a bubble?

WHY AI IS NOT A BUBBLE

The most important thing people forget is this: AI is not separate from normal computing, but is the culmination of computing’s goal itself. As proof, I always give one name: Alan Turing. He’s the father of modern computing, with his 1936 paper on the Turing Machine, algorithmic logic and computability, laying the theoretical foundation for digital computation.

Turing is also the grandfather of AI. His 1950 paper “Computing Machinery and Intelligence” introduced the concept of machine intelligence, including the now-famous Turing Test. He was among the first to ask whether machines could think, with the term “artificial intelligence” coined in 1956, a year after his tragic death.

So, the trillions spent on AI are just a fancy term for investment in digital computing infrastructure. Why fancy? Because you’ve never heard about the investments in undersea fibre optic cables, satellites, mobile networks, data centres, and a thousand other things that make up the world’s digital infrastructure. Trillions have been spent on these over the last three decades. But they weren’t filed under terms like AI or neural nets, hence never clubbed under a bubble ready to pop.

The investment in AI infrastructure you see today is essentially an upgrade of old non-AI digital infrastructure to an AI one, much like upgrading a traditional rail network for faster trains. It’s as simple as that: Most of the money flowing for AI isn’t for something entirely new, but merely an upgrade under a separate umbrella that falls under the larger computing umbrella that has seen exponential and well-justified investment increases for half a century.

TECH GIANTS

In the speculative dot-com bubble, companies with a lot of PowerPoint presentations and gyan often lacked real revenue or paths to profit. In contrast, today’s AI investments are backed by established tech giants with massive revenue streams, tangible infrastructure requirements, and proven applications across multiple industries.

Some of the biggest investors, especially Google and Amazon, are survivors of the dot-com bubble themselves. Unlike the speculative websites of yesteryear, which were often nothing but stories, today’s AI firms aren’t vaporware: they’re actual physical infrastructure being laid on the ground.

AI today is a genuine technological transformation with measurable productivity gains, unlike the dot-com bubble, which was largely built on speculative internet concepts without underlying substance. AI has had the quickest adoption in world history: faster than trains, cars, planes, phones, computers, the internet, social media, or smartphones: with almost everyone in the digital workforce and many outside it either using AI extensively or tinkering with it.

WHAT ABOUT THE NAYSAYERS

But what about the MIT report claiming 95% of companies spending on AI are failing to make money? I’ve already debunked the reporting on that paper in another Sify article, explaining how AI is adding value to companies, just not where researchers are looking or measuring.

Yes, I understand what ‘bubble’ means in this context: a market collapse due to overexposed stocks. A certain amount of market correction on AI stocks is indeed due. But to think of this correction as a near-total collapse, à la the 2000 dot-com bubble, that analogy is what I have a problem with.

But surely there could be conditions under which the AI bubble could still burst? I foresee that happening only if we all go back to the cave ages and abandon our mobiles, computers and all the tech that makes life easier. A more reasonable scenario? Not even World War III, because as the Ukraine War has shown, AI, data centres, and computing devices are integral to modern warfare and actually bloomed during that conflict.

And for those surprised by the rapid rise of AI after 2022, remember that it was not actually rapid. The many AI winters and a few small summers since 1956 tilled the land to prepare for this moment. The current AI summer began around 2010-12 when neural nets began guiding our social media feeds, maps, and language.

From then to 2022, when LLMs exploded, that is still a decade. The exponential rise of AI is like that of the Chinese bamboo species, which takes years to show growth above ground. But one day it grows so fast and tall, it’s soon the tallest thing around. In those years that you could not see growth, it was growing underground. Same with AI. You only see the rise now: you don’t see the thousands of researchers who did pathbreaking work for nearly seven decades before we had his moment.

So, once again, the big secret that those investing in AI know that doomsayers don’t is this: everything sooner or later has to become AI because “AI” isn’t a single product, it is an idea, which, when implemented on the ground, becomes a platform shift.

Almost every general computing will soon be AI computing; every digital device today will become an AI device tomorrow, with or without the funny AI-washing of products. And why wouldn’t it, when with AI, everything becomes better?

Does that mean companies will never fail? Not at all. Many AI companies will disappear before the next decade begins. But the bubble burst being predicted isn’t going to happen because it’s not a bubble in the first place. It’s a correction.

The money isn’t flowing into AI due to hype or speculation; it’s coming because AI represents the natural evolution of computing itself. When you understand that, you realise we’re not watching a bubble inflate, we are witnessing the foundation of tomorrow’s infrastructure being laid, one data centre at a time.

And the AI crash everyone’s waiting for? They’ll have to wait out their lives before it comes.

In case you missed:

- The Great AI Correction of 2026: Why the ‘Bubble’ Popping Could be the Sound of Growing Pains

- 75 Years of the Turing Test: Why It Still Matters for AI, and Why We Desperately Need One for Ourselves

- OpenAI, Google, Microsoft: Why are AI Giants Suddenly Giving India Free AI Subscriptions?

- From Generics to Genius: The AI Revolution Reshaping Indian Pharma

- These 3 Economists Discovered the Secret Code of Progress & the Formula to Survive AI

- How Can Indian AI Startups Access Global VC Funds?

- Great quantum poker: Who’s bluffing, and who is holding the aces?

- The AI Prophecies: How Page, Musk, Bezos, Pichai, Huang Predicted 2025 – But Didn’t See It Like AI Is Today

- How India Can Effectively Fight Trump’s Tariffs With AI

- Forget Chernobyl: Your Instagram Feed Might Cause The Next Nuclear Disaster

1 Comment

Let me summarize:

“It’s different this time!”