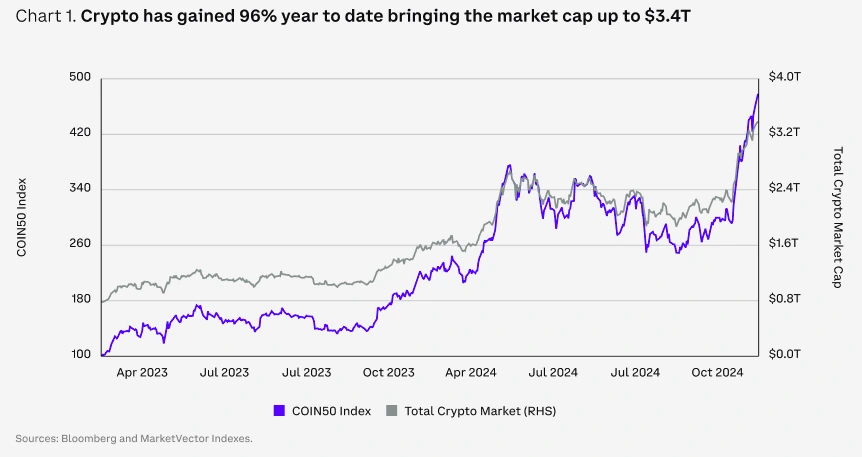

There was a time when Bitcoin was criticised as unpredictable and volatile. Today, the world’s best-known, oldest, and biggest cryptocurrency is in its third consecutive year of a hellishly impressive rally

The tide against cryptocurrencies has changed in the last decade, leading to growing acceptance among politicians, regulators, and most of all investors that cryptocurrencies — at least some of them — are a good route to long-term savings and wealth. In fact, some are even saying that they should be considered mainstream assets. The thought isn’t entirely unfounded, given the fact that cryptocurrencies are increasingly becoming embedded in financial markets.

According to data from CoinShares, more than USD 11 billion flowed into global funds tracking cryptocurrencies in the first half of 2025 alone, taking the total assets under management to a whopping USD 176 billion. To give you some perspective, it took gold some 5,000 years to reach a market cap of USD 18 trillion. In comparison, Bitcoin’s market cap within just 15 years of its existence is a cool USD 2 trillion. What changed the game?

The Evolution of Cryptocurrencies

Data provider and online platform CoinMarketCap alone tracks over 22,000 cryptocurrencies — and there are a lot more out there. This has certainly left investors bewildered, having to make complicated decisions on which ones to buy. The likes of Bitcoin, Ethereum, XRP, Solana, etc. might be the most accepted and popular digital currencies for regulators and fund managers, but there are many others that have been attracting the attention of investors over the years.

For instance, Trump has his own cryptocurrency. Then, there’s the potential gold mine Pi coin. And who can ignore Sui, the high-performing Layer 1 blockchain crypto, which has emerged as the frontrunner in the race for Web3 scalability.

Adding to the saga is the twist now known as stablecoins, which are backed by assets (US Treasuries, for instance). With US and even UK regulators putting forward proposals to regulate them, they’re now increasingly becoming potential alternatives to traditional payment systems.

Crypto: A Building Block To Wealth?

Since most crypto owners usually hold onto them for a longer period, proponents argue that cryptocurrencies belong to the value asset class. Others argue that they constitute an entirely new asset class. Their reasoning? Despite being similar to other asset classes, their unique set of features and characteristics that distinguish them from traditional asset classes makes them an asset class of their own. These include their risk-return trade-off profile, the correlation of returns, the politico-economic profile, and their investability.

What also makes these cryptocurrencies so lucrative, besides their function as a medium of digital exchange, is that they could support a greater functional use case or purpose. A prime example is Ethereum’s ether coin, which is both a currency and the fuel powering the Ethereum network, enabling DApps (decentralised applications) and smart contracts. Another example is the open-source, decentralised IOTA, whose objective is to develop real-life use cases for the IoT (Internet of Things).

There’s a lot more that points to crypto possibly being a potential building block to wealth. For one, more blockchain-based applications could be developed following improvements in blockchain technology, expanding the use cases for cryptocurrencies. Consequently, this could also result in greater demand for the cryptos that drive the activity on the blockchain.

Prices could be driven higher as a result, creating more value for long-term investors. They, in turn, could flush more capital into the ecosystem, leading to expanded use cases and newer developments. In short, it’s a virtuous loop.

Liquidity Concerns

That being said, the realm isn’t free from complications. As of July 2025, the market capitalisation of cryptocurrency is more than USD 3.9 trillion, making the category too big to ignore. It might be smaller when compared to the global market value of stocks, bonds, real estate, and even gold, but the current market cap of Bitcoin, which accounts for 60% of the crypto market, is USD 2 trillion. That itself is nearly 20 times of all outstanding GBP and greater than the total value of all outstanding JPY (Japanese Yen)!

Even then, Bitcoin’s actual liquidity is very low, with the average number of Bitcoin exchanged every day being equivalent to less than 0.06% of outstanding GBP and 0.05% of outstanding JPY. The other major cryptocurrencies, such as Cardano, Ethereum, etc., are even less liquid.

How Do I Decide What To Do?

It’s the era of the “crypto curious” who are now entering the investing space. These investors are looking for ways to diversify their growth, with some only looking to invest in Bitcoin and others having more of a look outside, too. They’re asking questions like ‘Where is this going to fit into my portfolio?’ and ‘How am I going to use this?’

In the end, the answer to whether crypto has arrived as an asset class has very little to do with regulation, governance, projected returns, market cap, trading volume, or correlations. It’s up to the individual investors, their bent of mind when it comes to investing, and how they plan for the future.

For those who view crypto as a way to potentially increase traditional wealth, they can be slotted in traditional asset classes. For those who regard crypto as a connection to a new kind of wealth, they definitely need to be categorised into their own class.

In case you missed:

- A Beginner’s Guide to Cryptocurrency Trading in India – Part 1

- A Beginner’s Guide to Cryptocurrency Trading in India – Part 2

- The Price Of Money: Can Cryptocurrency Go Green?

- Is Quantum Computing a Threat to Blockchain Security?

- From Memecoin To Meaning

- NFTs vs. RWA Tokenization – The Future of Digital Asset Ownership

- Tokenization of Real-World Assets: Assets Going Digital?

- How AI Can Fortify Cryptocurrency Security

- Cryptocurrency Cloud Mining: How Does It Work?

- Pi Day 2025: What Awaits The Pi Network on March 14th?