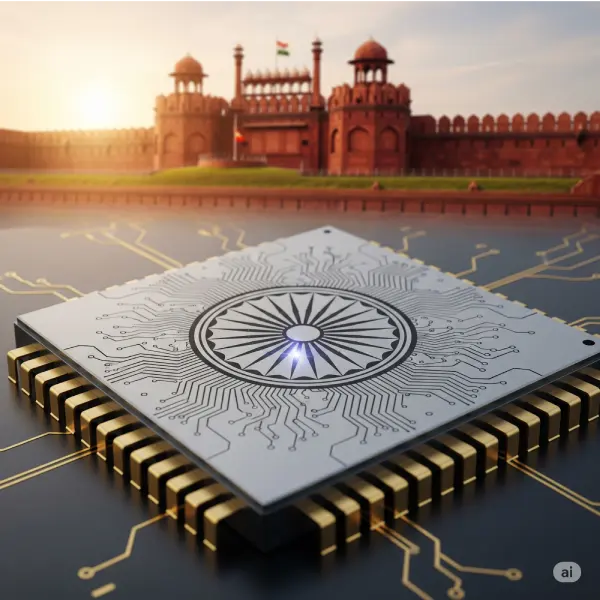

As global powers look beyond East Asia, India is pitching itself as the next trusted home for semiconductor fabs.

India’s semiconductor story is no longer just about Dholera or Sanand. On Independence Day, Prime Minister Narendra Modi underlined that semiconductors are not just about technology; they are about self-reliance, jobs, and national security. His words came as four new fabs were announced across Andhra Pradesh, Odisha, and Punjab, showing how the government’s ₹76,000-crore incentive scheme is reshaping the tech map of the country.

For decades, India was seen as strong in software but absent in hardware. Now, with global supply chains shifting and nations racing to secure chip production, India is playing catch-up fast. The symbolism of making such an announcement on August 15 was not lost; it linked semiconductors directly to the idea of freedom and strategic independence.

The question now is not whether India will build fabs, but how fast they can be operational and whether they can meet global quality benchmarks.

Andhra Pradesh, Odisha, and Punjab join the fab race

Andhra Pradesh is positioning itself as a new hub for high-tech investment, with a fab project near Visakhapatnam expected to create thousands of jobs while pulling in an electronics supply chain around it. Odisha, long overlooked for advanced manufacturing, is pitching its coastal advantages and political backing to host not one but two fabs, marking a big leap for a state better known for mining and metals.

Up north, Punjab is trying to make its case with a proposal near Mohali, leaning on the Semiconductor Laboratory (SCL) and research institutions already established in the region. While Maharashtra, alongside Karnataka and Gujarat, represents the country’s more traditional industrial base, the momentum is clearly shifting outward.

The new wave of projects suggests that India’s semiconductor story is widening. Instead of clustering in just a few states, fabs are spreading out, and that kind of geographical balance could be India’s hidden strength.

The real test is not just approvals; it’s execution. Building a fab isn’t like setting up an assembly line; it demands ultra-clean environments, billions in capital, and deep technical expertise. That’s why Odisha’s projects enjoy confirmed backing from global players like Intel and Lockheed Martin, while Andhra Pradesh brings in both Yitoa (Japan) for SiC fabrication and APACT (South Korea) for OSAT packaging.

In contrast, Punjab’s CDIL expansion near Mohali doesn’t yet have known international partners; though local institutions such as the Semiconductor Laboratory remain a potential anchor for future collaborations. India provides land, incentives, and young talent; global partners bring technology and transfer. Done right, this means India could soon manufacture chips, not just design them, and make regions like Punjab, Odisha, and Andhra Pradesh tech-forward powerhouses.

The Message from Modi

When Prime Minister Modi brought up semiconductors during his Independence Day speech, it wasn’t only about economics; it was also a carefully chosen political message. Casting chip fabs as a pillar of Aatmanirbhar Bharat was no accident. From the Red Fort, Modi went a step further, declaring, “By the end of this year, a Made-in-India chip, built in India by the people of India, will arrive in the market.” The statement wasn’t about technical specifications; it was a rallying cry.

By choosing semiconductors as an Independence Day theme, Modi was underscoring that this is not just a niche policy issue but a national mission. The subtext was clear: just as India once built atomic capability and space launch systems despite global skepticism, it now intends to claim its place in the global semiconductor race.

Of course, talk must be matched by delivery. Modi framed the endeavor as urgent, asserting that India “is working on semiconductors in mission mode.” That urgency resonates from academic labs to industrial corridors. For instance, SCL Mohali has just completed the fabrication of 20 semiconductor chips designed by students from 17 engineering institutes, and another 36 student-designed chips are in the pipeline for tape-out within six months. That milestone reflects real progress in India’s design ecosystem.

In addition to Odisha, Andhra Pradesh, and Punjab, which are ramping up capacities, ready to receive these innovations, states like Maharashtra, Karnataka, Gujarat, and Assam all have chip fabs in the pipeline. If India transforms even half these chip fab plans into reality, we will be a major semiconductor hub before the next decade begins.

This time it’s for real

What makes this moment different from past false starts is alignment; policy, capital, and geopolitics are converging in India’s favor. The U.S., EU, and Japan are all seeking trusted partners beyond East Asia, and India’s scale makes it hard to ignore. At home, rising electronics demand, from EVs to telecom to defense, creates a natural market for domestically made chips. Meanwhile, the government is pushing ahead with trusted foundry frameworks, workforce training, and tighter supply-chain security.

Unlike earlier eras when India hesitated, this time the country is moving with intent, speed, and coordination. For global investors, the signal is clear: India wants to be more than a buyer of chips; it wants to be a producer with strategic weight. If execution keeps pace with ambition, the next decade could see the phrase “Made in India” etched not just on software code and smartphones, but on the silicon heart powering the world.

In case you missed:

- India’s first Aatmanirbhar Chip Fab: TATA leads the way!

- India’s first Aatmanirbhar semiconductor chip is finally here!

- Tata Electronics to Manufacture Intel Chips & AI Laptops in India!

- Aatmanirbhar Push: India Becomes 7th Nation to Crack Gallium Nitride Chip Technology

- India’s First Paid Chip Prototype: Kaynes Fires the Starting Shot

- One Chip to Rule Them All: The 6G Chip at 100 Gbps!

- India, iPhones, China & Trump: The Foxconn Story!

- Goodbye Blackwell, Hello Rubin: Nvidia’s new AI platform is here!

- India’s Mappls Revolution: The Swadeshi Push to Dethrone Google Maps

- The Sodium-Ion Breakthrough That Could Unplug Lithium’s Reign